We ensure that investors can access, track and manage their portfolio anytime, anywhere.

Invest In Mutual funds Online!

Why waste time in long queues at the Bank or take an effort in paperwork when you can now invest in mutual funds online? HDFC securities presents HDFC money, a unique platform that offers you quick and hassle-free mutual fund investments online. Apart from ease of investing, this online mutual fund platform also ensures that you can access your portfolio, manage as well as track your investments and withdraw them anywhere, anytime. HDFC money is a 100% digital platform and your ideal one-stop shop for mutual fund investments online. Invest in mutual funds online and take that first step towards creating a nest egg for your and your family’s future.

Why Invest In Mutual Funds With HDFC money?

24 * 7 Availability

Easy Tracking Of Portfolio

Our advanced Portfolio Tracker offers seamless tracking of your Mutual Fund investments online.

Tax Saving Solutions With ELSS

We assist our investors with ELSS Mutual Funds ideal for tax saving and help them start investing online.

Exhaustive Choice Of Funds

With HDFC Money, you can choose to start your investment in Mutual Funds online, in over 30 AMCs

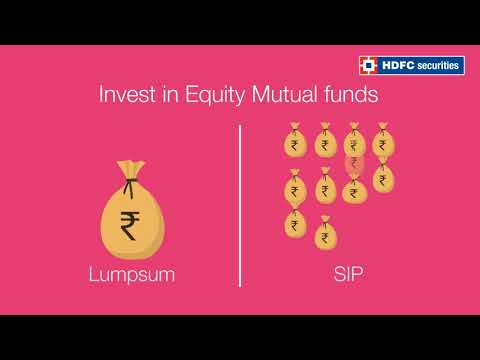

Multiple Modes Of Investments

Apart from one-time, HDFC Money also offers investors to choose between STP, SWP and SIP mode of investment.

Zero Account Opening Charges

HDFC Money is a unique Mutual Fund investment platform with zero account opening charges.

Top Mutual Funds To Invest

8.81

8.81 %

3 years

1,08,81012.68

12.68 %

3 years

1,12,6807.46

7.46 %

3 years

1,07,460How To Open A Mutual Fund Account Online?

We constantly strive to offer advanced digital solutions for all our investors, in order to ensure a seamless investment journey.

Want to know how to instantly open your HDFC Money account with HDFC Securities, without any paperwork?

Registration steps for KRA Compliant individual to open a paperless HDFC Money account online

-

Step 1:

Fill in your details on our Registration page -

Step 2:

Enter the OTP you receive on registered mobile number and email ID -

Step 3:

Enter your PAN details to check KYC compliance. -

Step 4:

Check the auto-populated FATCA and Compliance Questionnaire fields and click Proceed. -

Step 5:

Enter your bank details and signature.

That’s all! Starting your investment journey on HDFC Money is as easy as opening your very own Mutual Fund investment account online.

Testimonials

HDFC Money is an amazing platform for busy employees like me. It is fairly simple to use, quick with investment processes and also offers detailed portfolio view. They even have ELSS options wherein I can be stress-free about my tax planning. HDFC securities has done a great job with this top-notch initiative. I am an avid HDFC Money user and I would urge you all to try this out!— Rohan Chhabra, BNP Paribas

It’s a free account for your Mutual Fund investments and that alone was motivation for me to try HDFC Money! After having used it a couple of times I realize it is much more than that- ease of investing, quick processes, multiple AMCs to choose from and a completely online, paperless process! I really couldn’t have asked for more. HDFC Money is an amazing digital initiative and it works for me on every level. Kudos HDFC sec!— Pallavi Kabre, JP Morgan

Stress-Free Investments. Better Returns!

Backed by a rich legacy and unwavering customer focus, we are the partners you can depend on

HDFC Bank

subsidiary

End-to-end

investment solutions

Distinguished

industry credentials

Prompt

customer service

FAQs

For login, the investor needs to provide the contact number or email ID provided at the time of registration. Accordingly, the investor will receive an OTP. There will not be any separate login ID or password

No, if you don’t have trading account with HDFC securities but you are a KYC compliant you can invest through HDFC money platform

Yes, you can transact in mutual funds during holidays and the transactions will be processed on the next trading day.

Any resident Indian, aged above 18 years, can open an account and start investing with HDFC money.

No worries, you can complete online KYC on HDFC money platform.

Complying with KYC norms is a fairly simple and one-time process. If you have completed the KYC process earlier, through a SEBI-registered intermediary (like a broker, DP, Mutual Fund etc) then you don’t have to undergo the KYC process again.

Investors who need to get KYC Compliant must submit the following documents:

- KYC application form filled out by each applicant (including joint unit holders).

- Documents showing proof of identity and proof of address.

There are no charges for opening and maintaining a HDFC money account.

Mutual Fund's Educational Videos

We have curated best of the videos to help you get started on your investment journey with HDFC money. Watch these educational videos and learn everything about online investment in mutual funds.

What is STP(Systematic Transfer Plan) & SWP(Systematic Withdrawal Plan) | HDFC securities