International Diversification

Diversify country risk from your portfolio by diversifying geographically

Diversify with 10,000+ U.S. Stocks and ETFs

Diversify with 10,000+ U.S. Stocks and ETFs Plans with 1 cent brokerage available

Plans with 1 cent brokerage available Assets protected up to $500,000 by SIPC

Assets protected up to $500,000 by SIPC Load funds completely online at the lowest FX rates

Load funds completely online at the lowest FX rates Securities offered through VF Securities Inc.(member FINRA/SIPC)

Securities offered through VF Securities Inc.(member FINRA/SIPC)

Diversify country risk from your portfolio by diversifying geographically

Possible benefit from combined effect of USD appreciation and price appreciation

Set and achieve investment goals in US dollars such as retirement corpus, education fund, or a dream vacation

Netflix

Netflix

Microsoft

Microsoft

Amazon

Amazon

Starbucks

Starbucks

Meta Platforms

Meta Platforms

Tesla

Tesla

Model portfolios based on focused themes or diverse asset exposure

Moat contains a curated list of companies with deep business moats and leading market shares in their respective sub-sectors.

SAAS Vest curates companies with Software as a Service (SaaS) business model, which derive the majority of their revenue from business-oriented software products.

Sign up using email or social sign-in

Sign up on HSL with any of the sign-up methods provided. This includes sign up with email, Google, or Apple

Submit Your Address Proof and ID Proof

Complete KYC in minutes with our fully digital and streamlined Journey

-202407181730320467443-202504161255048312133.png)

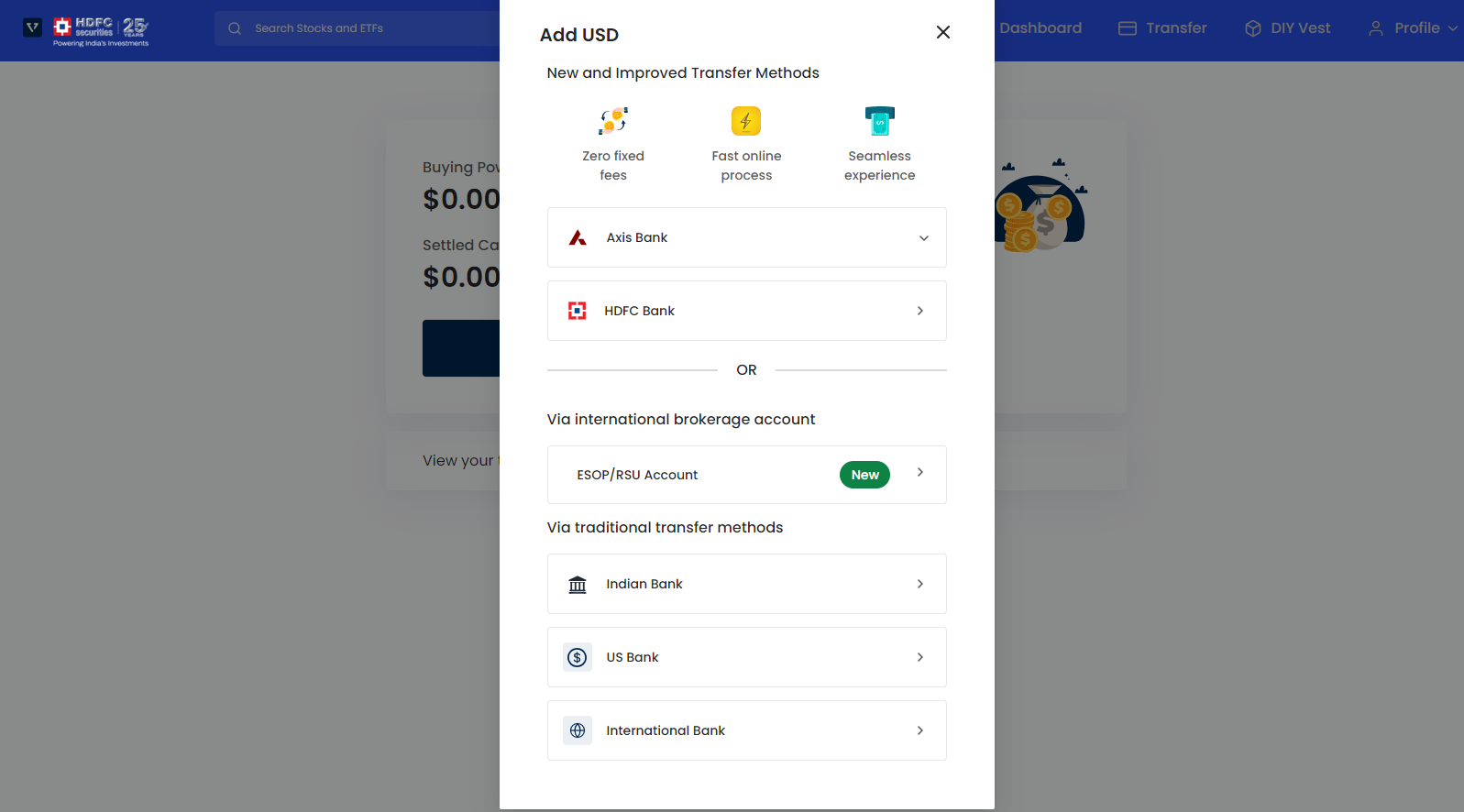

Choose from a range of funding methods

Add USD to your account using integrations with banks such as HDFC, Axis and others, or from international banks, or using proceeds from ESOP/RSU

Are you an investor looking to diversify your portfolio and explore new opportunities? Investing in U.S stocks from India can offer a range of benefits that may appeal to you.

By understanding these processes and requirements upfront, Indian investors can navigate the complexities of investing in U.S stocks more effectively.

Investing in U.S stocks from India offers exciting opportunities, but it's crucial to be aware of the risks and challenges that come with it. One of the main risks is currency exchange fluctuations, as changes in the value of the Indian rupee against the U.S dollar can impact your investment returns.

Another challenge is navigating through different tax regulations and requirements in both countries, which can sometimes be complex and time-consuming to understand. Moreover, geopolitical events or economic policies in either country can also affect stock prices unpredictably.

Furthermore, investing in foreign markets comes with inherent market risk due to factors such as volatility and potential lack of familiarity with specific U.S companies. It's essential for Indian investors to conduct thorough research and stay informed about global economic trends to mitigate these risks effectively.

When investing in U.S stocks from India, it's essential to conduct thorough research before making any decisions. Stay informed about market trends and global events that may impact your investments.

Diversify your portfolio by investing in a mix of different sectors and industries to spread out risk. This can help protect your investments during market fluctuations.

Take advantage of dollar-cost averaging by consistently investing a set amount at regular intervals. This strategy can help smooth out the effects of market volatility over time.

Keep an eye on currency exchange rates as they can impact the value of your investments when converting back to Indian Rupees. Consider using tools or services that offer competitive exchange rates for better returns.

Stay disciplined and avoid making emotional decisions based on short-term market movements. Stick to your investment plan and goals for long-term success in global investing.

A government issued ID, a local tax ID, and proof of address are required for opening an account for Global Investing

For Indian investors, PAN and Aadhaar will be needed for account opening.