Large institutions also have huge capital requirements and so they take “Debt” periodically with a promise to pay back. And the guaranty assuring that promise is known as a bond. Unlike a Stock, Debt involves borrowing money with the PROMISE or Obligation to pay it back in full on Maturity, along with interest over time. That’s why debt instruments are also called Fixed income instruments

Most diversified investment portfolios contain some allocation each to stocks and bonds, where bonds are often considered the more conservative choice of the two.

There are several kinds of bonds available Like Tax-free bonds, RBI Bonds and Capital gain bonds.

One of the hugely-popular investment options, especially among high net worth investors, is tax-free bond. The income by way of interest on these Bonds is fully exempt from Income Tax and shall not form part of Total Income

These bonds are generally issued by Government Backed entities and thus have very low default risk. And even though they have a tenure of 10-20 years, they are listed on stock exchanges to offer an exit route.

Another popular bond to avail Tax exemption is called 54 EC bond the best ways to save long-term capital gains tax from investments or sale of property. while you save tax by investing in these bonds, you also earn interest income on the same.

So, in a way, you get paid to save tax.

Give your portfolio stability and steady growth with the help of bonds.

Know more to grow more.

Investment in securities market are subject to market risks, read all the related documents carefully before investing

SEBI Registration Nos.: INB011109437 (BSE -EQ) / INB231109431 (NSE-EQ) /INF231109431 (NSE -FO) / INF011109437 (BSE -FO)/ INE231109431 (NSE-CD) |NSE Member Trading Code: 11094 | BSE Clearing Number: 393 | AMFI Reg No. ARN -13549, PFRDA Reg. No - POP 04102015, IRDA Corporate Agent Licence No.-HDF2806925/HDF C000222657, Research Analyst Reg. No. INH000002475, CIN-U67120MH2000PLC152193. Registered Address: I Think Techno Campus, Building B, Alpha, Office Floor 8, Near Kanjurmarg Station, Kanjurmarg (East), Mumbai -400 042. Tel -022 30753400 Compliance Officer: Ms. Binkle R Oza. Ph: 022-30453600 Email: [email protected].

Disclaimer : HDFC securities Ltd is a financial services intermediary and is engaged as a distributor of financial products & services like Corporate FDs & Bonds, Insurance, MF, NPS, Real Estate services, Loans, NCDs & IPOs in strategic distribution partnerships. Customers need to check products & features before investing since the contours of the product rates may change from time to time. HDFC securities Ltd is not liable for any loss or damage of any kind arising out of investments in these products. Investments in Equity, Currency, Futures& Options are subject to market risk. Clients should read the Risk Disclosure. Document issued by SEBI & relevant exchanges & the T&C on www.hdfcsec.com before investing. Equity SIP is not an approved product of Exchange and any dispute related to this will not be dealt at Exchange platform.

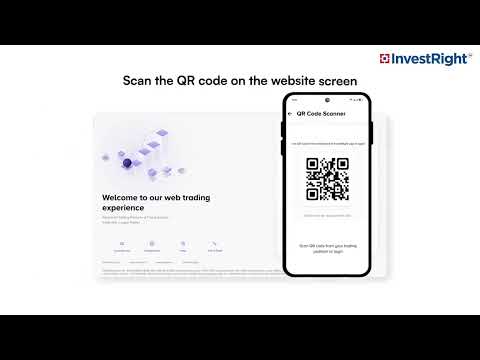

HSL Mobile App

HSL Mobile App