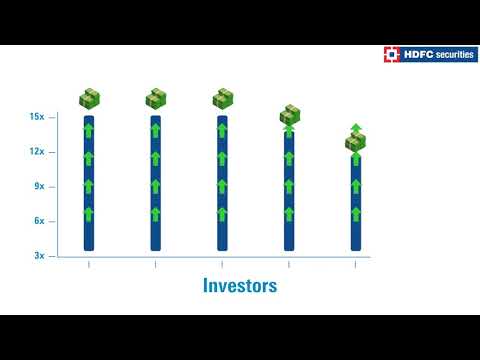

Individuals may do wonders once or twice, But to succeed in the long term, what you really need is a team with diverse abilities. So instead of hunting for that one lucky stock or putting all your money in one sector

You should be carefully building and managing a well-diversified equity portfolio for long term growth.

Start with understanding your own investing requirement.

Look at your financial goals,

Risk appetite, and the length of time you intend to hold this portfolio

Determine the kind of investor you are.

Diversification is the basis on which strong portfolios are created.

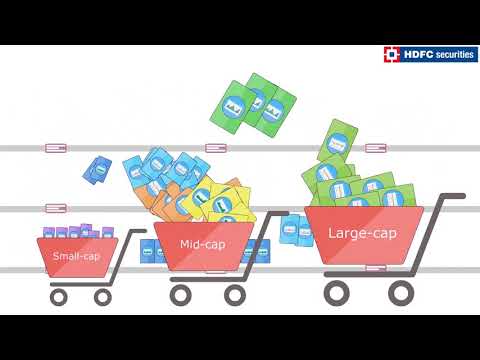

Allocate your budget across multiple sectors and market capitalization. The devil is in the details. Get to know your stock by going through multiple data points before buying.

And once you have purchased the stocks, check it periodically. Look at the return on equity.

Monitor the diversification of your portfolio, making adjustments when necessary, and you will greatly increase your chance of long-term financial success. Even in the face of structure changes in the economy over time

Speak to our relationship managers who will advise you on the best approach.

Watch more videos to grow more.

Investment in securities market are subject to market risks, read all the related documents carefully before investing

SEBI Registration Nos.: INB011109437 (BSE -EQ) / INB231109431 (NSE-EQ) /INF231109431 (NSE -FO) / INF011109437 (BSE -FO)/ INE231109431 (NSE-CD) |NSE Member Trading Code: 11094 | BSE Clearing Number: 393 | AMFI Reg No. ARN -13549, PFRDA Reg. No - POP 04102015, IRDA Corporate Agent Licence No.-HDF2806925/HDF C000222657, Research Analyst Reg. No. INH000002475, CIN-U67120MH2000PLC152193. Registered Address: I Think Techno Campus, Building B, Alpha, Office Floor 8, Near Kanjurmarg Station, Kanjurmarg (East), Mumbai -400 042. Tel -022 30753400 Compliance Officer: Ms. Binkle R Oza. Ph: 022-30453600 Email: complianceofficer@hdfcsec.com.

Disclaimer : HDFC securities Ltd is a financial services intermediary and is engaged as a distributor of financial products & services like Corporate FDs & Bonds, Insurance, MF, NPS, Real Estate services, Loans, NCDs & IPOs in strategic distribution partnerships. Customers need to check products & features before investing since the contours of the product rates may change from time to time. HDFC securities Ltd is not liable for any loss or damage of any kind arising out of investments in these products. Investments in Equity, Currency, Futures & Options are subject to market risk. Clients should read the Risk Disclosure. Document issued by SEBI & relevant exchanges & the T&C on www.hdfcsec.com before investing. Equity SIP is not an approved product of Exchange and any dispute related to this will not be dealt at Exchange platform.

HSL Mobile App

HSL Mobile App