During an IPO, a Company sells its shares in the stock market. BUYBACK in that sense is opposite of an IPO. It is when a company offers to repurchase its shares from existing shareholders.

The reasons for Buyback are many.

A common reason is a large cash surplus in the balance sheet.

Buyback is one way to make use of this surplus. And by reducing the number of shares in the open market, the value of each share rises also improving the Earnings Per Share Ratio of the company

The company may be reducing some of its dividend liability by buying back shares and thus, reducing cost. If the price is at a premium to the market price, a buyback can be an attractive and safe opportunity.

It makes more sense if you feel the share price in the market is overvalued, or you don’t believe there are opportunities to grow earnings at the same pace going forward.

To safeguard from arbitrage, most companies announce Buyback with a “record date”. Only shares that are bought on or before record date are eligible for buy back

But study carefully about the company’s fundamentals, recent news or speak to our relationship managers to guide you.

Know More to Grow More

Investment in securities market are subject to market risks, read all the related documents carefully before investing

SEBI Registration Nos.: INB011109437 (BSE -EQ) / INB231109431 (NSE-EQ) /INF231109431 (NSE -FO) / INF011109437 (BSE -FO)/ INE231109431 (NSE-CD) |NSE Member Trading Code: 11094 | BSE Clearing Number: 393 | AMFI Reg No. ARN -13549, PFRDA Reg. No - POP 04102015, IRDA Corporate Agent Licence No.-HDF2806925/HDF C000222657, Research Analyst Reg. No. INH000002475, CIN-U67120MH2000PLC152193. Registered Address: I Think Techno Campus, Building B, Alpha, Office Floor 8, Near Kanjurmarg Station, Kanjurmarg (East), Mumbai -400 042. Tel -022 30753400 Compliance Officer: Ms. Binkle R Oza. Ph: 022-30453600 Email: [email protected].

Disclaimer : HDFC securities Ltd is a financial services intermediary and is engaged as a distributor of financial products & services like Corporate FDs & Bonds, Insurance, MF, NPS, Real Estate services, Loans, NCDs & IPOs in strategic distribution partnerships. Customers need to check products & features before investing since the contours of the product rates may change from time to time. HDFC securities Ltd is not liable for any loss or damage of any kind arising out of investments in these products. Investments in Equity, Currency, Futures& Options are subject to market risk. Clients should read the Risk Disclosure. Document issued by SEBI & relevant exchanges & the T&C on www.hdfcsec.com before investing. Equity SIP is not an approved product of Exchange and any dispute related to this will not be dealt at Exchange platform.

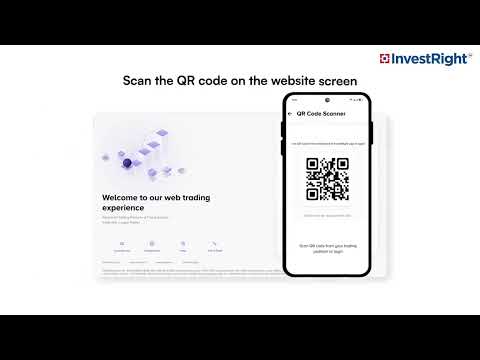

HSL Mobile App

HSL Mobile App