Vasudha wants to invest in the market but is scared of the volatility that is inherent in the market. She happens to get her hands on an article on Debt Mutual Funds written by Yojak.

Debt Mutual Funds invest in a mix of fixed income securities such as Treasury Bills, Government Securities, Corporate Bonds, Money Market instruments and other debt securities with a fixed maturity date &pass on the interest earned from them to its investors.

Debt funds are preferred by individuals not willing to invest in a highly volatile equity market. A debt fund provides a steady yet lower income compared to Equity but is less volatile.

Debt securities are assigned 'credit rating' by independent rating agencies which helps assess the ability of the issuer to pay back their debt, over a certain period of time.

Earning in debt mutual funds is through -

Dividend or interest payments

Capital gains based on the difference between the purchase and sale price of the debt security

There are several benefits of Debt Mutual Funds:

Your investments are relatively safe and not affected by equity market volatility

They add stability to your investment portfolio

Easy liquidity gives you freedom to withdraw your money when required

Various types of Debt funds are:

Liquid Funds or Money Market Funds

Floating Rate Funds

Short Term & Medium Term Income Funds

Income Funds

Corporate Bond Funds

Fixed Maturity Plans or Close Ended Debt Funds

Hybrid Funds

Satisfied, Vasudha decides to invest her savings in Debt Mutual Funds to safeguard her money and earn a steady return on her investment. If market volatility gives you anxiety, then Debt Mutual Funds are the investment option for you.

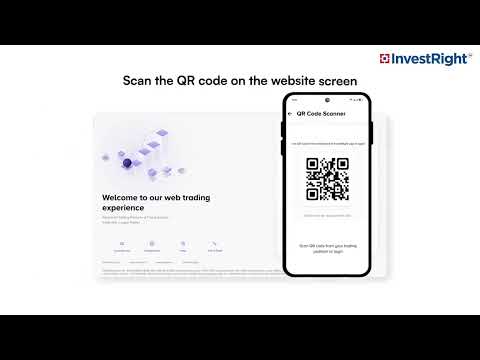

HSL Mobile App

HSL Mobile App