Kavita is worried because she wants to save tax but doesn’t know how. She decides to consult Yojak to give her a solution to save tax.

Yojak tells her to invest in Equity Linked Savings Scheme or ELSS to not just save tax but as an investment tool as well.

An ELSS is a diversified equity mutual fund which has a majority of the corpus invested in equities.

It has a 3 year lock-in period and investment upto 1.5 Lakhs in ELSS qualifies for income tax exemption under Section 80C.

ELSS funds have both dividend and growth options. Investors get a lump sum at the end of 3 years in growth schemes.

While in a dividend scheme, investors get a dividend income, whenever dividend is declared by the fund.

It’s an investment which saves tax as well as helps in generating wealth towards achieving medium term financial goals like children’s education, buying a car or planning a vacation.

It offers a higher return than PPF or FD and you have the option of a monthly SIP in ELSS.

ELSS Funds are suitable for all types of investors who are not risk averse and need to invest in tax planning instruments.

Yojak advises Kavita to evaluate a funds past performance, risk adjusted returns and consistency before selecting a best performing ELSS scheme.

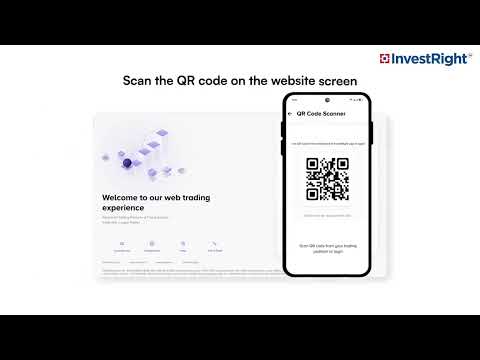

HSL Mobile App

HSL Mobile App