Sarthak is still in his first year of job but has his life goals sorted. He wants to take his parents to a nice vacation, buy a car and a comfortable flat and retire easy. He’s financially smart and invests in Equity Mutual Funds.

A mutual fund is a professionally managed pool of money collected from investors for the purpose of investing in securities such as stocks, bonds, money market instruments and other assets. This forms what is called a portfolio.

Equity mutual funds invest the pooled investor money into shares of various companies. The price paid or value of each share is known as Net Asset Value or NAV.

Equity Mutual Funds are the most numerous and popular form of Mutual Funds. They offer widespread diversification to investors with a medium and high risk appetite.

Investing in Equity Mutual funds can be through a one timelumpsum amount or through a Systematic Investment Plan or SIP.

Gain in Equity Mutual Funds is through Growth in NAV or Dividend Payout.

NAV growth denotes growth in value of investor’s capital. The profit investor makes stays reinvested to earn more money through compounding.

While under dividend payout, profit earned in the Equity fund is paid to investors in the form of dividend payouts.

Mutual funds are an ideal investment vehicle for regular investors and new investors. So plan your financial goals and start investing.

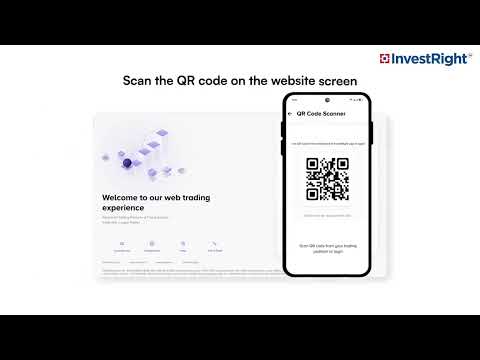

HSL Mobile App

HSL Mobile App