What if a sudden critical illness or disability prevents you from working?

Health emergencies are never planned, they simply strike without warning. With rising medical expenses the cost of treating a critical illness may deplete your savings.

A health insurance provides financial protection by covering the insured’s medical and surgical expenses and offers considerable flexibility towards disease or ailment coverage. The policy continues even after the benefit payout on illnesses.

Payment terms could be either the insured paying costs and getting subsequently reimbursed or the insurance company reimbursing costs directly.

The features of health insurance are:

These policies cover expenses related to pre and post hospitalization, day care and ambulance charges among others

Critical illness and disability covers ensure steady payout of a part of your regular income in case of a major illness or disability

Premium paid towards health insurance is deductible under section 80D

With health insurance, you are assured of a more secure future both health-wise and money-wise. So cover yourself and your family with the right health insurance plan today.

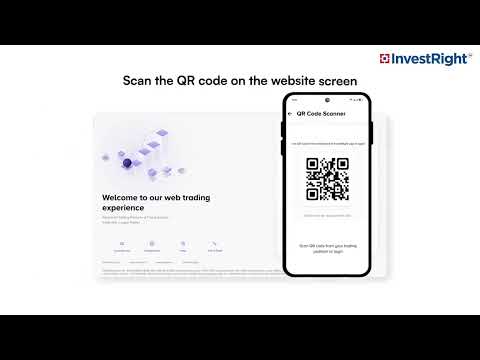

HSL Mobile App

HSL Mobile App