There are 3 main indicators you would use to assess derivatives like Futures and Options.

These are: Open Interest, Volumes and Put-Call Ratio (PCR)

Let’s start by understanding Open Interest.

Let’s say Rishabh sells 1 contract to Neha. He is said to be SHORT on that contract and Neha is said to be LONG on the same contract.The Open Interest in this case is 1.If Neha sells her position to Vishal, the Open Interest still remains 1.

Once Vishal takes delivery for the agreed price from Neha, the Open Interest squares off to Zero.

On any date, Open Interests are the number of options or futures contracts that are not closed or delivered.

Here’s an example of a fictional company LMS, whose ‘July Futures’ is being traded in lots of 250 units each:

The Open Interest for ‘LMS July Futures’ today in the entire market therefore, is 1,26,10,500. OI is analysed by traders in conjunction with price.

Volumes indicate how many shares are bought and sold over a given period.

Here’s a fictional trading day. The more active the share, the higher would be its volume.

High volumes indicate the presence of institutional or influential buyers. Low volumes indicate retail participation. When you associate it with price and volume trend, then inferences can be made regarding market trends.

The Put Call Ratio helps us identify extreme bullishness or bearishness in the market.

This simple ratio tends to signal an upcoming trend reversal.

If the PCR value is above 1, One can look for reversals and expect the markets to go up.

If PCR PCR value is around 0.5 and below, one can expect the markets to go down.

Values between 0.5 and 1 can be attributed to regular trading

Taken together, OI, Volumes and PCR help us confirm trends and patterns to gain market insights.

Talk to our advisors to know how you can use indicators to your advantage. Know More to Grow More

Investment in securities market are subject to market risks, read all the related documents carefully before investing

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

SEBI Registration No.: INZ000186937 (NSE, BSE, MSEI, MCX) |NSE Trading Member Code: 11094 | BSE Clearing Number: 393 | MSEI Trading Member Code: 30000 | MCX Member Code: 56015 | AMFI Reg No. ARN -13549, PFRDA: POP-11092018, IRDA Corporate Agent Licence No.-HDF2806925/HDF C000222657, Research Analyst Reg. No. INH000002475, CIN-U67120MH2000PLC152193. Investment Adviser: INA000011538. Registered Address: I Think Techno Campus, Building, B, Alpha, Office Floor 8, Near Kanjurmarg Station, Kanjurmarg (East), Mumbai -400 042. Tel -022 30753400. Compliance Officer: Ms. Binkle R Oza. Ph: 022-3045 3600 Email: complianceofficer@hdfcsec.com.

Disclaimer : HDFC Securities Ltd is a financial services intermediary and is engaged as a distributor of financial products & services like Corporate FDs & Bonds, Insurance, MF, NPS, Real Estate services, Loans, NCDs, IPOs, E-Will & E-Tax in strategic distribution partnerships. Customers need to check products & features before investing since the contours of the product rates may change from time to time. HDFC securities Ltd is not liable for any loss or damage of any kind arising out of investments in these products. Investments in Equity, Currency, Futures & Options are subject to market risk. Clients should read the Risk Disclosure Document issued by SEBI & relevant exchanges & the T&C on www.hdfcsec.com before investing. Equity SIP is not an approved product of Exchange and any dispute related to this will not be dealt at Exchange platform.

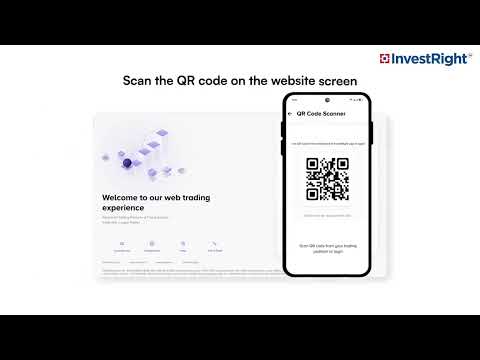

HSL Mobile App

HSL Mobile App