For decades now, Arun’s family has been serving the tastiest vadapav in pune. Arun convinces his family to take their vadapav joint pan india but needs 1 Crore for expansion. Arun plans to raise this amount directly via investors He invests 50 lakhs from his own pocket and Remaining 50 lakhs are raised by giving up 50% equity of the company. This 50% equity is distributed as 50,000 shares priced at Rs 100/- each.

With 1 crore successfully raised, Arun opens 15 centres across India in 5 years. and now his company has a valuation of Rs 15 Cr. Each investor who had bought shares from Arun multiplied their investments by 15 times.

In essence, shares mean part ownership of a company. In practice however, Arun would have to raise funds via IPO in the primary markets. Subsequently, the shares are traded between institutional and individual investors in secondary markets like NSE & BSE. Stock markets allows companies to raise money on one hand and lets investors participate in financial growth of the companies, in turn making money.

Watch more videos to know more.

Investment in securities market are subject to market risks, read all the related documents carefully before investing

SEBI Registration Nos.: INB011109437 (BSE -EQ) / INB231109431 (NSE-EQ) /INF231109431 (NSE -FO) / INF011109437 (BSE -FO)/ INE231109431 (NSE-CD) |NSE Member Trading Code: 11094 | BSE Clearing Number: 393 | AMFI Reg No. ARN -13549, PFRDA Reg. No - POP 04102015, IRDA Corporate Agent Licence No.-HDF2806925/HDF C000222657, Research Analyst Reg. No. INH000002475, CIN-U67120MH2000PLC152193. Registered Address: I Think Techno Campus, Building B, Alpha, Office Floor 8, Near Kanjurmarg Station, Kanjurmarg (East), Mumbai -400 042. Tel -022 30753400 Compliance Officer: Ms. Binkle R Oza. Ph: 022-30453600 Email: complianceofficer@hdfcsec.com.

Disclaimer : HDFC securities Ltd is a financial services intermediary and is engaged as a distributor of financial products & services like Corporate FDs & Bonds, Insurance, MF, NPS, Real Estate services, Loans, NCDs & IPOs in strategic distribution partnerships. Customers need to check products & features before investing since the contours of the product rates may change from time to time. HDFC securities Ltd is not liable for any loss or damage of any kind arising out of investments in these products. Investments in Equity, Currency, Futures & Options are subject to market risk. Clients should read the Risk Disclosure. Document issued by SEBI & relevant exchanges & the T&C on www.hdfcsec.com before investing. Equity SIP is not an approved product of Exchange and any dispute related to this will not be dealt at Exchange platform.

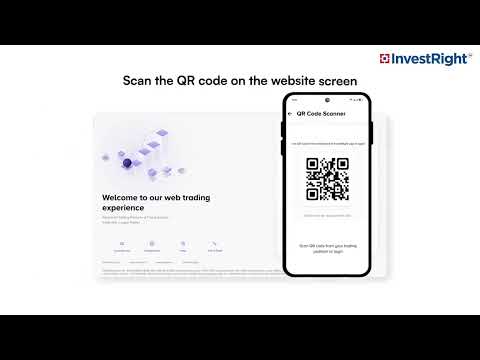

HSL Mobile App

HSL Mobile App