Life is unpredictable.

Sandhya, a mother of 2 children, recently lost her husband. Bringing up children alone would have been difficult but Santosh had planned for the future and invested in a term plan.

A term plan provides financial stability to surviving family members to pay off liabilities and maintain their living standards in the event of untimely death of the main earning member.

However, if the insured outlives the policy term, the policy expires and there are no maturity benefits.

As a thumb rule, one should have life cover of at least 15-20 times one’s annual income. One should also decide whether their family should receive lump-sum, or staggered pay-outs planned systematically, in case of an unfortunate eventuality

Benefits of Term Insurance:

Offers financial security to your dependents in your absence

Low premiums

Provides peace of mind

Premium is deductible under section 80C and claim amount is tax free

It is advisable to take a term plan as early as possible because premiums increase with age.

A term plan is the most basic and essential insurance that you must have.

https://www.hdfcsec.com/productpage/general-insurance

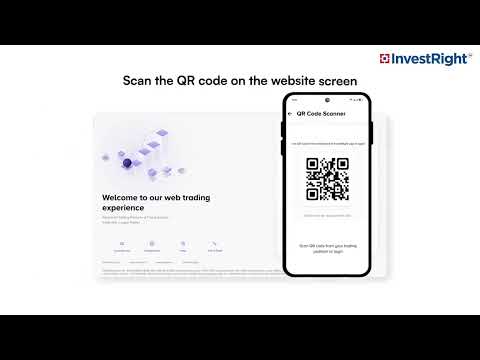

HSL Mobile App

HSL Mobile App