Protect Your Trades with Bracket Orders from HDFC Securities

What separates a good investor from a great one is their use of effective risk management. And the most popular and efficient risk management tools in trading are placing stop loss and taking profit orders. This should ideally be done at the time a trader places their initial trade. With stop loss and take profit orders, traders effectively put a ceiling to the downside risk, while locking in profits.

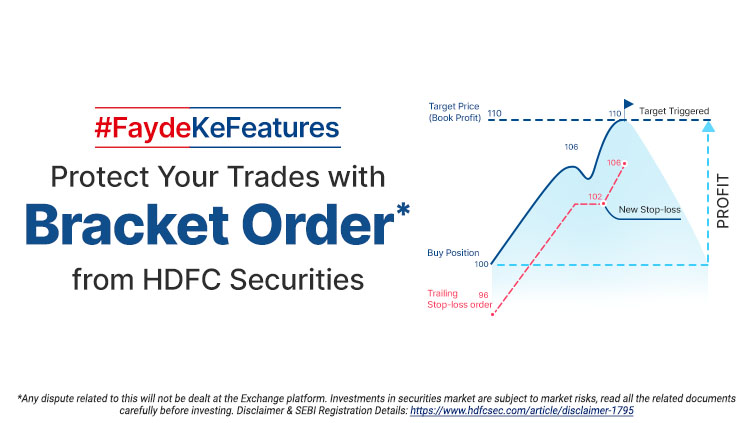

To ease this process, HDFC Securities offers bracket orders, as part of its #FaydeKeFeatures initiative. The company is committed to helping clients make the most of the markets. For this, HDFC Securities regularly introduces innovative features and functionalities on its web trading platform and mobile trading app to make trading simple and convenient. The #FaydeKeFeatures initiative is another step in fulfilling this commitment to client success.

What are Bracket Orders?

Bracket orders simplify risk management by allowing traders to place their initial order, along with stopping loss and taking profit orders. With this facility, rather than having to place each of these orders separately and tracking the market direction before placing an order, the trader can bracket a buy order with a higher take profit (sell) order and lower stop-loss order, and vice versa for a sell order, all from a single order panel.

So, a bracket order essentially has 3 components – the initial order, the stop-loss order and the take profit order. The distance in terms of price between the brackets (stop loss and take profit) represents the potential profit or loss range for a trade. When either the stop loss or the take profit order is executed, the other order is automatically cancelled. HDFC Securities also allows traders to place bracket orders with trailing stops to further minimise losses.

Why Use Bracket Orders?

HDFC Securities added this feature to its web trading platform because it ensures effective risk management by limiting the downside and locking in profits. So, the biggest advantage of using bracket orders is that it ensures disciplined trading. Discipline is one of the key pillars of success in trading the financial markets.

In the absence of pre-defined exit points, traders might feel tempted to hold on to a losing position, in the hope that the market would turn in their favour. On the other hand, traders might exit a position too soon out of fear that a winning position could reverse if the market trend changes. Emotions lead to poor decision-making, which could lead to mounting losses. By placing pre-decided entry and exit points for each trade, disruptive emotions like fear and greed are eliminated from the decision-making process.

*Disclaimer - The information is only for consumption by the client and such material should not be redistributed.

Related Posts

Don't miss another Article

Subscribe to our blog for free and get regular updates right into your inbox.

Categories

newsletter

HSL Mobile App

HSL Mobile App