Elevate your Trading with InvestRight’s Analyze feature

The Position Analyzer in the HDFC InvestRight app acts as your personalized trading assistant, providing a comprehensive set of derivatives market data to empower your trading decisions. It offers real-time insights on open positions, effortless understanding of options Greeks, and clear visualization of payoffs. With its user-friendly interface and customized trade summary, it’s the go-to tool for every level of options trader. InvestRight’s Analyze feature makes precision trading a breeze.

How to Analyze F&O Positions?

To analyze an open F&O position in InvestRight, follow these simple steps:

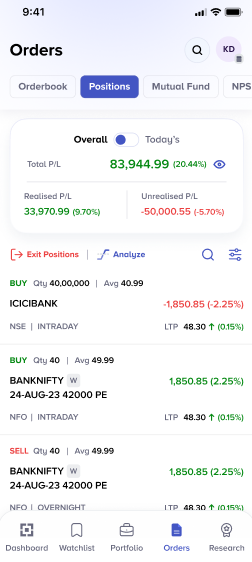

1. Go to the Order Page and click on Position tab, then, Click the Analyze button to analyse F&O position.

Once you click on the Analyze button, you’ll be taken to a new page where all positions are sorted by the underlying asset.

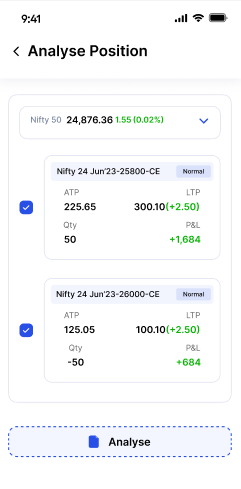

2. Select the Underlying asset you want to analyze from the dropdown menu and Click Analyze to get valuable insights into your open positions.

After this, you’ll access key insights like a trade summary, Analyze - payoff graph and options Greeks.

Features and Interpretation:-

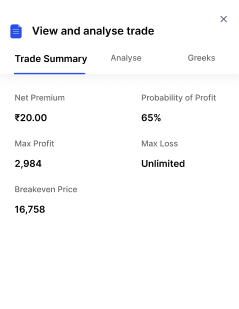

Trade Summary

The Trade Summary provides a concise overview of your F&O position or strategy, including maximum risk, maximum profit, breakeven point, and probability of profit. This data supports more informed trading decisions.

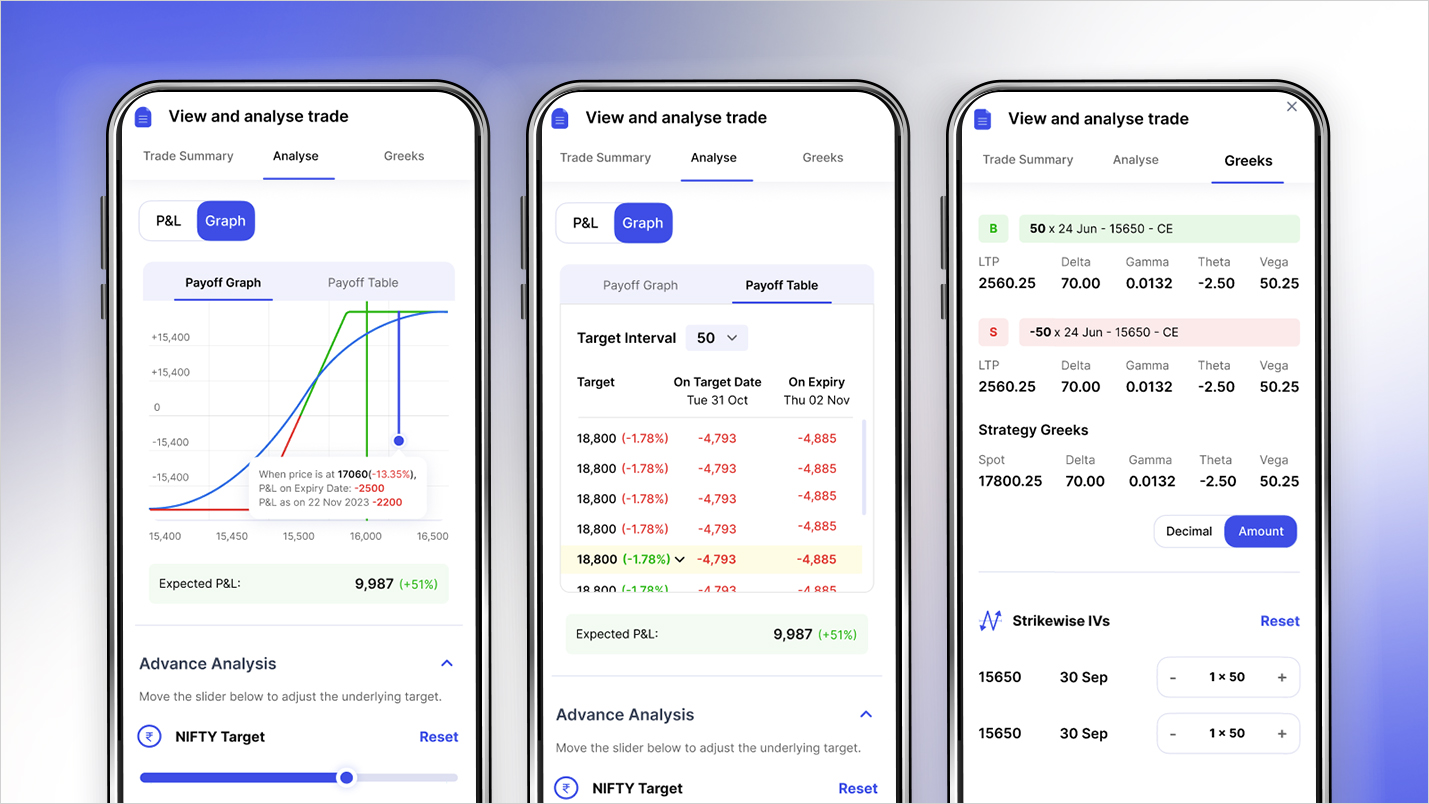

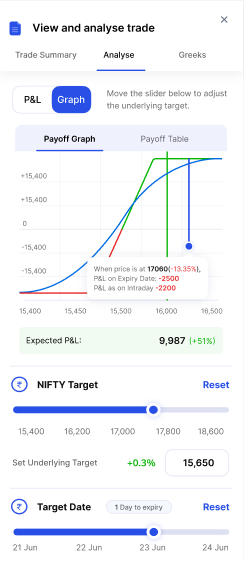

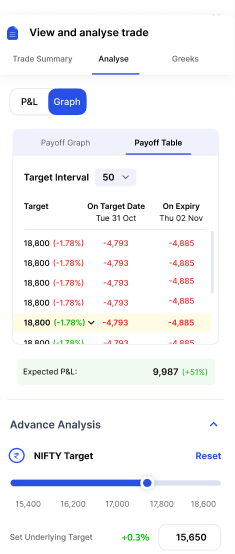

Analyze Payoff and Graphs

In the Analyze section, you can review your position cumulatively across all selected legs. It displays the profit & loss (P&L) in a table format and a payoff graph.

Payoff Graph: This graph visually displays potential profits or losses. As you adjust the target and date using the slider, the graph updates dynamically, plotting the new P&L outcome.

Payoff P&L Table: This table shows P&L on each leg individually and the overall strategy based on the target date and time selected.

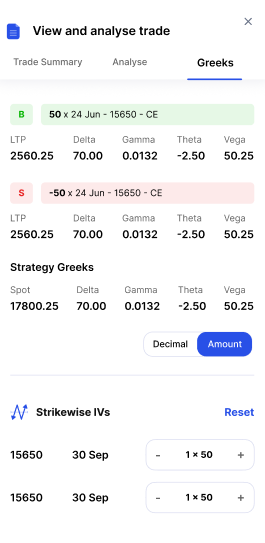

Greeks

This section offers a detailed breakdown of the Greeks for your overall strategy and each leg. You can explore how changes in market conditions (like implied volatility) impact your positions. Adjusting the implied volatility lets you see its effect on Vega, helping you understand risk exposure at both individual and strategy levels.

With these tools, traders can evaluate potential outcomes of their F&O strategies and understand the risks and rewards of each scenario. You can select a target price, date, and time to see how different market conditions affect your position, allowing for more informed decision-making.

Try the Payoff Analyzer on the HDFC InvestRight app today and unlock the potential of F&O trading!

Happy Trading!

Related Posts

Don't miss another Article

Subscribe to our blog for free and get regular updates right into your inbox.

Categories

newsletter

HSL Mobile App

HSL Mobile App