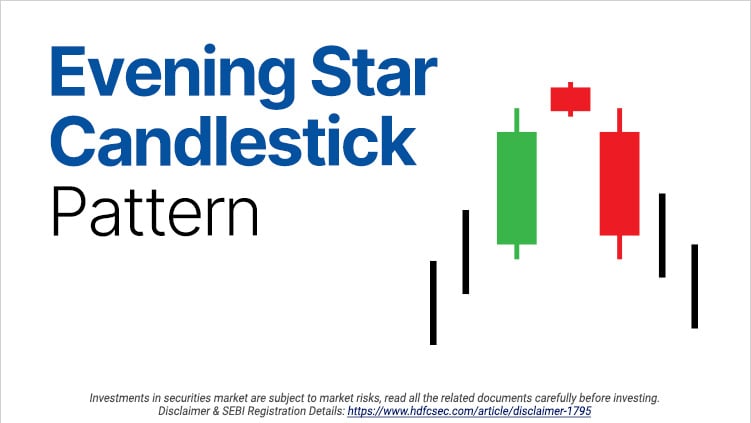

Evening Star Candlestick Pattern

The ability to read a candlestick chart is one of the most basic skills in technical analysis. Learning and understanding candlesticks can help a trader see the trends in the stock price, recognize patterns and also use them as a base of a strategy. There are several different types of patterns that a trader should be aware of. These candlestick patterns indicate a trend reversal, continuation, or breakout. In this article, we will learn about the evening star candlestick pattern.

What is the Evening Star Candlestick Pattern?

The evening star candlestick pattern is a bearish trend reversal candlestick pattern. This pattern is helpful in detecting the top of an up-move and indicates the trend reversal. Similar to the morning star candlestick pattern, the evening star pattern is made up of three candlesticks. Although, it is important to know that the evening star pattern is the opposite of the morning star pattern. The morning star pattern indicates the trend reversal after a downtrend whereas the evening start pattern indicates a trend reversal after an uptrend.

How to Identify an Evening Star Candlestick Pattern?

An evening star candlestick pattern is made up of three candlesticks.

- The first candlestick is a large bullish candlestick. This shows the continuation of an uptrend.

- The second candlestick opens at a gap-up from the previous day’s closing but is smaller in size. This indicates uncertainty in the market.

- Finally, the third candlestick is a large bearish candle. The third candlestick opens at a gap-down from the previous day’s closing. This indicates selling pressure in the market.

Interpretation of the Evening Star Candlestick Pattern

The evening star candlestick pattern can help traders catch a trend reversal. It is important to understand why this pattern is significant.

- This pattern usually comes during an uptrend or when the market is bullish. The first candle is a large bullish candle which indicates that there are more buyers present and the trend will most likely continue in the same direction. The price of the stock creates a new high with this candle.

- The second candle opens a gap-up which leads to more buyers entering the stock, but the price of the stock does not move higher. The candle is usually a Doji or a spinning top candle. This candlestick is especially significant if it forms near an important resistance level. The formation of such a candle might lead to some fear in the buyers.

- The third candle opens at a gap-down from the closing price of the previous day. This might lead to panic selling from the buyers and more sellers will enter as well. The formation of a large bearish candle confirms the evening star candlestick pattern.

Traders should enter into trades after the third candlestick has formed. This confirms that the trend has reversed and more bearish price action can be seen. However, traders should not rely on candlestick patterns in isolation. It is important to note the significant levels of support and resistance while also using other indicators to get more confirmation.

Related Posts

Don't miss another Article

Subscribe to our blog for free and get regular updates right into your inbox.

Categories

newsletter

HSL Mobile App

HSL Mobile App