Protect Your Portfolio

HDFC, Tester

Portfolio protection against COVID-19 Coronavirus

Using asset allocation to build a recession-proof portfolio

Coronavirus has spread from China and,in the last few weeks, mass infections have been reported across the globe. Many countries are taking extreme steps to control the virus — Japan has shut down its schools, Saudi Arabia has suspended pilgrimage trips etc.

Uncertainties always de-stabilise global market

The virus has also begun impacting global markets. Investors across the world were afraid that the disease would impact global trade harshly,and,over the last few weeks, the markets have reflected the concerns. Nifty has descended from 12350 to 11300, since mid-Jan’20. This represents a fall of more than 9%.

Is there a product that can provide protection against market fall, while still ensuring higher returns in the long term? The answer is — yes, there is. It is called All Weather Investing.

A protective cover

The All Weather portfolio has two objectives —

- Provide significantly higher returns than the traditional bank instruments like savings and FD

- Provide stable returns so that money can be invested and withdrawn at any point in time without worrying about market highs and lows

Let’s look at the performance of the All Weather portfolio to check if it meets the above mentioned objective

The Portfolio’s Performance

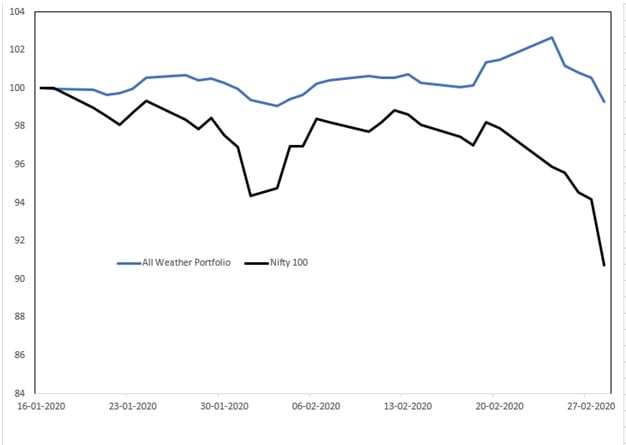

Its performance since Coronavirus concerns started impacting the market (16 Jan’20 to 27 Feb’20) is almost flat while Nifty 100 is down by more than 9%.

Box 1: All Weather Vs Nifty 100 since mid of Jan’20

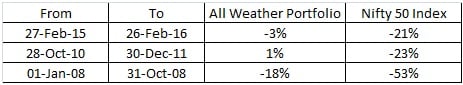

Let’s also check how the portfolio performed historically duringsimilar market low periods to see whether it consistently fulfills the said objectives.

Box 2: All Weather vs Nifty 50 in down periods

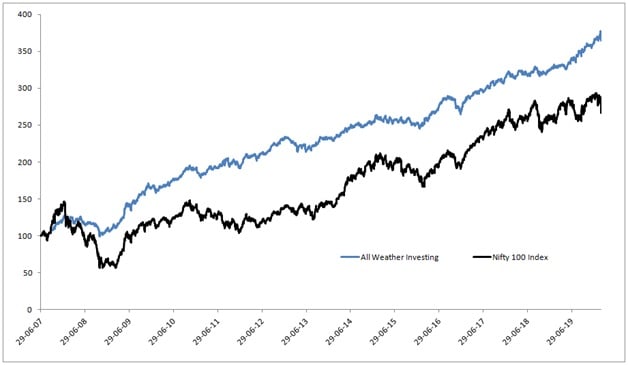

While protection against market volatility is important, it is equally important to generate good returns in the long term. To check this, let’s compare the performance of the portfolio against market volatility since Jul’07.

Box 3: All Weather vs Nifty 100 since Jul’07

Conclusion

So, does the All Weather portfolio always give positive returns?It attempts to reduce the impact of negative returns byinvesting in three asset classes — gold, equity and debt. Equity & gold asset classes offer volatile returns and the idea is to come up with a mix that can reduce the extent and frequency of negative returns.

Is it good for all types of investors? In my opinion, yes! Different investors can choose different percentage allocations towards the core. Also, when in doubt, they can consult an investment advisor but, according to me, everyone should have a core product in their portfolio.

Is the All Weather portfolio really recession-proof? It significantly minimises the damage that a sudden market fall or a prolonged recession can have on your portfolio. So, yes, it protects your portfolio in all types of rough weathers. Yeh, #HarMarketMeinChalega.

Related Posts

Don't miss another Article

Subscribe to our blog for free and get regular updates right into your inbox.

Categories

newsletter

HSL Mobile App

HSL Mobile App