Value Plans Terms & Conditions

I hereby declare that:

- GST, STT and other statutory fees will be charged separately and will be paid by me for transactions done in my trading account, as per the regulatory requirements.

- Any Free Transaction Turnover is in addition to the other offerings, if any. Irrespective whether I trade or do not trade during the validity period, the fees would remain the same.

- Any research service is only an add-on service provided by HDFC securities Limited and does not constitute an offer/invitation and/or a solicitation by HDFC securities Limited to purchase/sell or otherwise deal in securities in any manner.

- Any communication by HDFC Securities Ltd. is only by way of information. Any decision, action or omission thereon shall be entirely at the client's risk and should be based solely on my (the client's) own verification of all relevant facts, financial and other circumstances, a proper evaluation thereof and the client's investment objectives and I/we shall not hold HDFC securities Limited and/or any of its representatives liable for the same. HDFC Securities Ltd should not be held responsible for any delay of information sent by SMS / Email.

- This scheme will be co-terminus with the client-member agreement, Power of Attorney. Rights and obligations executed/confirmed by me with/to HDFC securities Limited in respect of my captioned trading account.

- I (the client) will not hold HDFC Securities Ltd. responsible for, or liable for, any actions, claims, demands, losses, damages, costs, charges and expenses which they may suffer, sustain or incur by way of above offer.

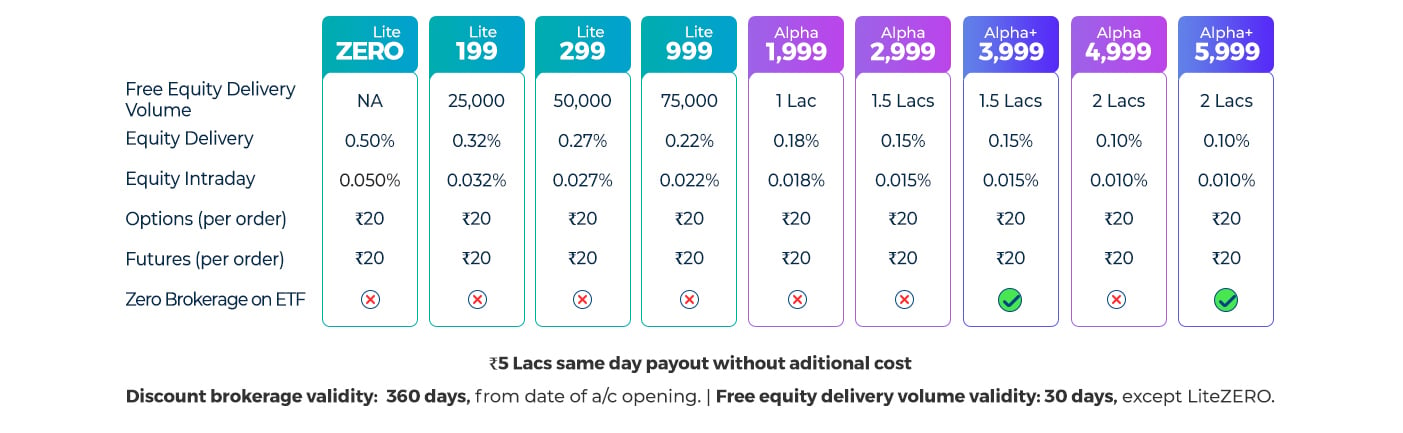

- Brokerage of Re. 0.01 will be charge per order/trade wherever free volume / zero brokerage on ETF conditions are applicable. Once the free volume is utilized or validity is expired, then the discounted brokerage rate will be applicable.

- Above plans are only available for Resident accounts and are exclusive of GST. The validity of scheme will be for 360 days or till such time these scheme are offered by HDFC Securities, whichever is earlier. At the end of 360 days from the date of registration scheme will be auto renewed and amount be debited from the linked bank account.

- Derivatives privilege should be availed within 30 days from the date of account opening. If not then standard rate will be applicable. For same day payout client need to select Encash as a product and it is available on selective stocks only, however normal delivery brokerage will be applicable.

- Minimum brokerage of Rs. 25 per order will be applicable for equity segment i.e. both intraday and delivery (Subject to the ceiling of 2.5%) based transaction. For the stocks below Rs. 10, brokerage of 5 paisa per share will be applicable (Subject to the ceiling of 2.5%).

- Standard brokerage rate will be applicable for all the other segment, which are not mentioned in the scheme or T&C.

- This offering should not be construed as any prepaid brokerage offer. It is non-refundable under any circumstances, and is non-transferable.

- If I avail for another brokerage scheme at any point of time, then the above offer stands forfeited for the remaining days of the scheme and above benefits may not be applicable to other offer selected by me and I (the client) cannot claim any refund / concern under any circumstances.

- For detailed disclaimer and product terms and conditions refer our website www.hdfcsec.com

Client Consent:

I have read and understood the above terms and conditions and agreed to the same. I hereby authorize HDFC Securities Ltd., to debit the charges as consented above and as applicable for the scheme subscribed by me/us. I/We undertake that sufficient balances shall be maintained in the said account to facilitate the debiting of the charges else the scheme would not be activated.

__title__

__answer__

__title__

__url__

HSL Mobile App

HSL Mobile App