Aether Industries Limited IPO : Issue Opens May 24, 2022

Incorporated in 2013, Aether Industries Limited is a manufacturer of speciality chemicals. The company is the sole manufacturer in India of chemicals such as 4-(2-Methoxyethyl) Phenol (4MEP), 3-Methoxy-2-Methylbenzoyl Chloride (MMBC), Thiophene-2-Ethanol (T2E), Ortho Tolyl Benzo Nitrile (OTBN), N-Octyl-D-Glucamine, Delta-Valerolactone and Bifenthrin Alcohol.

The company has three business models: Large scale manufacturing of intermediates and speciality chemicals, CRAMS (contract research and manufacturing services) and Contract manufacturing.

Aether Industries has two manufacturing sites at Sachin in Surat, Gujarat. Manufacturing Facility 1 is a 3,500 square metre facility including R&D and Hydrogenation Facilities and Pilot Plant. Manufacturing Facility 2 encompasses roughly 10,500 square metres, with an installed capacity of 6,096 MT per year spread among three buildings and 16 production streams as of September 30, 2021.

As of March 31, 2022, Aether Industries Limited's product portfolio comprised over 25 products which were sold to over 34 global companies in 18 countries and to over 154 domestic companies. The company is the largest manufacturer of 4MEP, T2E, NODG and HEEP products in the world by volume.

Objects of the Issue:

The company proposes to utilise the Net Proceeds from the Fresh Issue towards funding the following objects:

- Prepayment or repayment of all or a portion of certain outstanding borrowings availed by the Company.

- Funding capital expenditure requirements for the manufacturing facility (Proposed Greenfield Project).

- Funding working capital requirements of the Company.

- General corporate purposes.

Competitive Strengths

- Differentiated portfolio of market-leading products.

- Focus on R&D to leverage the core competencies of chemistry and technology.

- Long-standing relationships with a diversified customer base.

- Synergistic Business Models focused on Large Scale Manufacturing, CRAMS and Contract Manufacturing.

- Focus on Quality, Environment, Health and Safety (QEHS).

- Strong and consistent financial performance.

- Experienced Promoters and Senior Management with extensive domain knowledge.

Company Promoter: Ashwin Jayantilal Desai, Purnima Ashwin Desai, Rohan Ashwin Desai, Dr. Aman Ashvin Desai, AJD Family Trust, PAD Family Trust, RAD Family Trust, AAD Family Trust and AAD Business Trust are the company promoters.

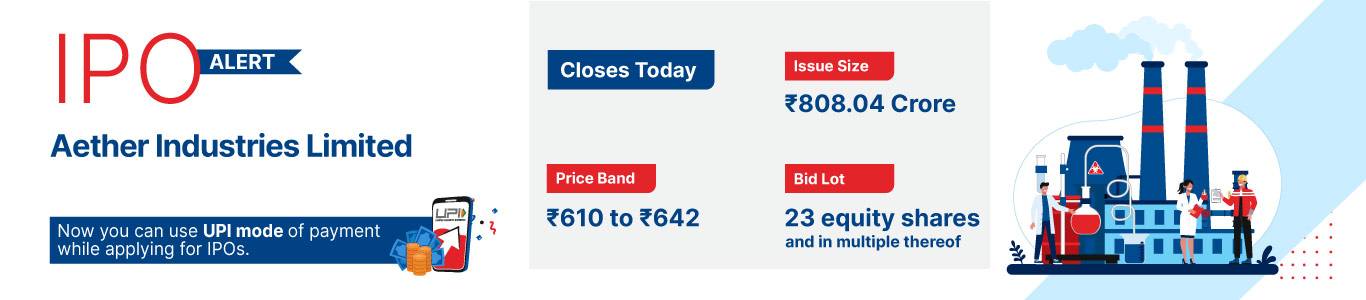

Issue Details

Company Financials

| Particulars | For the year/period ended (₹ in Million) | ||||

| 31-Dec-21 | 31-Dec-20 | 31-Mar-21 | 31-Mar-20 | 31-Mar-19 | |

| Total Assets | 7095.61 | 4000.95 | 4529.44 | 3004.67 | 2066.75 |

| Total Revenue | 4493.15 | 3373.41 | 4537.89 | 3037.81 | 2032.77 |

| Profit After Tax | 829.06 | 482.54 | 711.19 | 399.56 | 233.35 |

HSL Mobile App

HSL Mobile App