AGS Transact Technologies Limited IPO : Issue opens 19th Jan 2022

AGS Transact Technologies Ltd is one of the India's leading omni-channel payment solution providers. It is the second largest company in India in terms of revenue from ATM managed services and also the largest deployer of POS terminals at petroleum outlets in India. It not just serves Indian market but also expanded internationally in other Asian countries including Sri Lanka, Cambodia, Singapre, Indonesia, and Philippines. The firm primarily operates in 3 business segments;

1. Payment Solution services such as ATM and CRM outsourcing, cash management services, digital payment solutions, transaction switching services, POS machine services, agency banking, etc. As of March 31, 2021, it has a portfolio of 13,959 ATMs and CRMs under outsourcing and 18,408 ATMs and CRMs under managed service segment. It has also deployed POS terminals at leading Indian petroleum outlets such as Hindustan Petroleum, Indian Oil Corporation while Dr. Lal Pathlabs, Patanjali Ayurved, RJ Corp Ltd, VRIPL Retail Pvt Ltd, Organic India are the corporate clients.

2. Banking Automation Solutions i.e. Sale of ATM and CRM, self-service terminals, currency technology products, and relevant services. As of March 31, 2021, AGS Transact has 50+ banking customer base i.e. ICICI Bank. Axis Bank, and HDFC Bank Ltd.

3. Other Automation Solutions for customers in petroleum, retail, and colour segments such as system automation products, system integration, remote management, and other service offerings.

As of March 31, 2021, it had installed a network of 207,335 merchant POS, 16,700 petroleum outlets, 72,000 ATMs and CRMs offering cash management services, 46000 cash billing terminals, and installed 85,700 colour dispensing machines. The business serves customers in 2200 cities and towns through 420,000 machines or customer touch points.

Objects of the Issue:

The IPO aims to utilize the net proceed for the following objectives;

- To carry out an offer for sale by selling shareholders.

- To realize the listing benefits of equity shares on the stock exchange.

Competitive strengths:

- An integrated omni-channel payment and cash solutions provider.

- Diversified product portfolio, customer base, and revenue stream.

- Strong capabilities to develop customized in-house solutions.

- Long-standing relationship with global technology providers i.e. Diebold Nixdorf, ACI.

- Strong in-house infrastructure and technological capabilities.

Company Promoters:

Mr. Ravi B. Goyal and Vineha Enterprises Pvt Ltd are the company promoters.

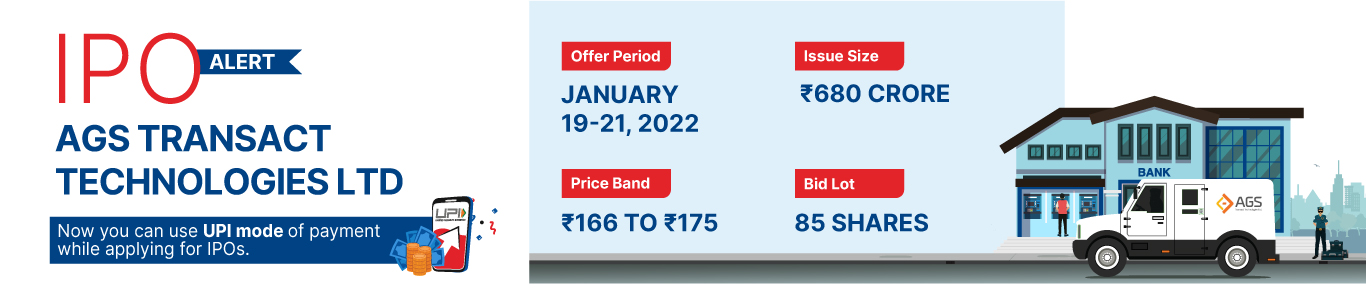

Issue Details

Company Financials

| Particulars | For the year/period ended (₹ in million) | ||

| Summary of financial Information (Restated Consolidated) | 31-Aug-21 | 31-Mar-21 | 31-Mar-20 |

| Total Assets |

29,170.33 |

29,138.32 |

22,413.95 |

| Total Revenue | 7,623.04 | 17,971.52 | 18,335.26 |

| Profit After Tax |

(181.05) |

547.92 |

830.14 |

HSL Mobile App

HSL Mobile App