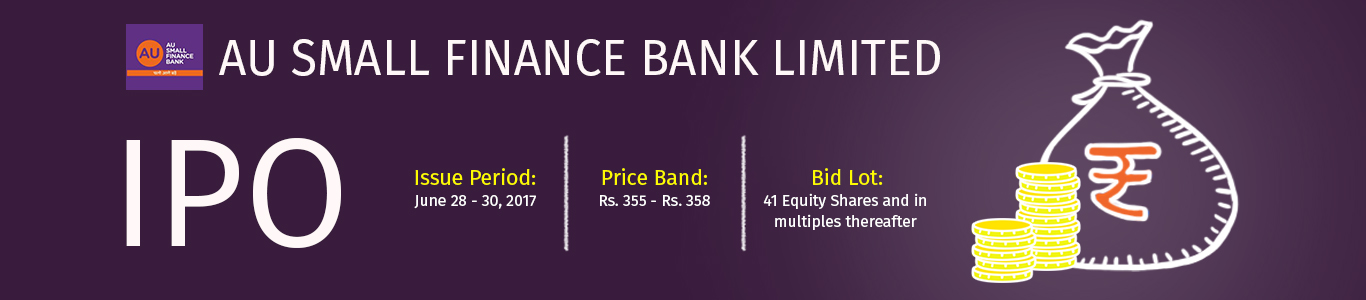

AU SMALL FINANCE BANK LIMITED

|

Background & Operations

AU Small Finance Bank Limited a small finance bank (“SFB”) that has recently transitioned from a prominent, retail focused non‐banking finance company (“NBFC”), which primarily served low and middle‐income individuals and businesses that have limited or no access to formal banking and finance channels.

As an NBFC, it operated in three business lines: vehicle finance; micro, small and medium enterprises (“MSMEs”) loans; and small and medium enterprises (“SMEs”) loans. As the Company commenced its SFB operations, it has expanded and strengthened its business model to offer a diverse suite of banking products and services by leveraging its asset‐based lending strengths, NBFC customer base and cost efficient, technology driven hub‐and spoke branch operating model to successfully operate Its SFB. In addition to its vehicle finance, MSME and SME offerings, its asset product offerings include working capital facilities, gold loans, agriculture related term loans, Kisan credit cards for farmers and loans against securities. Its liability product offerings include current accounts, savings accounts, term deposits, recurring deposits and collections and payments solutions for MSME and SME customers. It believes that transitioning to an SFB has offered it a significant growth potential and it aims to be a retail focused, preferred trusted SFB offering integrated and tailored solutions to customers.

Objects of Issue:

The objects of the Offer are to achieve the benefits of listing the Equity Shares on the Stock Exchanges and for the Offer for Sale of 53,422,169 Equity Shares.

|

__title__

__answer__

__title__

__url__

HSL Mobile App

HSL Mobile App