Bracket Order

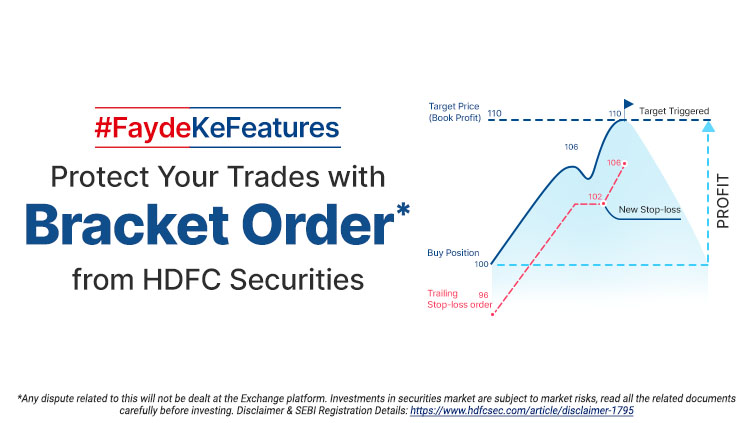

A Bracket order is a cover order type where you create the first leg position (buy/sell) at market price and simultaneously need to place a square off order for profit booking (target) and a stop loss from a single order panel. This help’s to limit downside and lock in your profit/loss.

A BUY order is bracketed by a high-side sell limit order (profit booking) and a low-side sell stop order and vice versa for a SELL order. When either of the order (profit or stop-loss) gets executed, the other order will be cancelled.

Bracket order comes with Trailing Stop loss functionality which would help minimize the loss further.

Bracket order is only available for cover product.

Yes, it is mandatory to mention a book profit price to complete the bracket order.

The trail will take place at the same tick rate of the underlying stock/contract. For example: For a nifty contract, the minimum movement is 0.05, and hence, the same will be the minimum movement for the trailing stop loss.

Bracket order is not available on Mobile app and ProTerminal as of now. However, we will soon be coming up with the order type on these platforms.

HSL Mobile App

HSL Mobile App