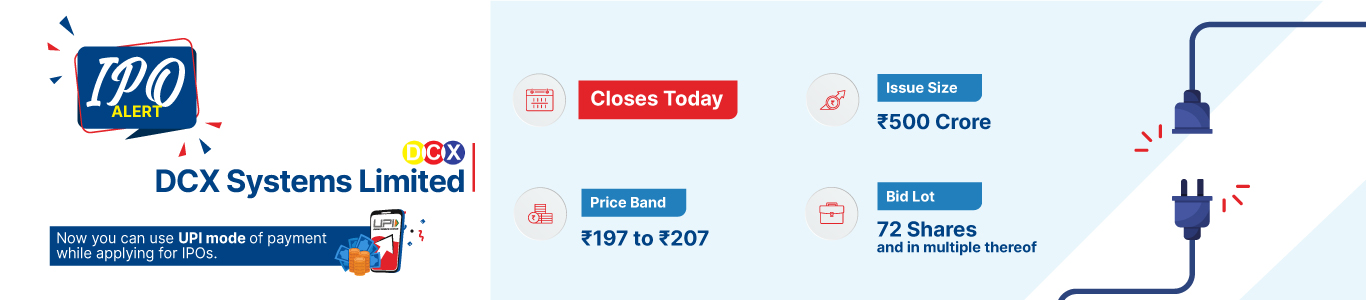

DCX Systems Limited IPO

DCX Systems Limited is among the leading Indian players in the manufacture of electronic sub-systems and cable harnesses. The company commenced operations in 2011 and has been a preferred Indian Offset Partner ("IOP") for foreign original equipment manufacturers ("OEMs") for executing aerospace and defence manufacturing projects.

In 2020, the company commissioned a new manufacturing facility at the Hi-Tech Defence and Aerospace Park SEZ in Bengaluru, Karnataka.

As of June 30, 2022, DCX Systems had 26 customers in Israel, the United States, Korea and India, including certain Fortune 500 companies, multinational corporations and start-ups. The company's customers include domestic and international OEMs, private companies and public sector undertakings in India across different sectors, ranging from defence and aerospace to space ventures and railways.

DCX System's key customers include Elta Systems Limited, Israel Aerospace Industries Limited - System Missiles and Space Division, Bharat Electronics Limited, and Astra Rafael Comsys Private Limited, among others

In Fiscal 2020, 2021 and 2022 and in the three months ended June 30, 2021, and June 30, 2022, DCX Systems' revenue from operations was Rs. 4,492.62 million, Rs. 6,411.63 million Rs. 11,022.73 million, Rs. 1,229.14 million and Rs. 2,132.54 million, respectively.

The company's business verticals:

- System integration in areas of radar systems, sensors, electronic warfare, missiles, and communication systems.

- Cable and Wire Harness Assemblies.

- The company supplies assembly-ready kits of electronic and electro-mechanical parts.

Objects of the Issue:

The company proposes to utilise the Net Proceeds of the Fresh Issue towards funding the following objects:

- Repayment/ prepayment, in full or part, of certain borrowings availed of by the Company.

- Funding working capital requirements of the Company.

- Investment in our wholly owned Subsidiary, Raneal Advanced Systems Private Limited, to fund its capital expenditure expenses.

- General corporate purposes.

Company Financials

|

Particulars |

For the year/period ended (₹ in Crores) | ||

| Summary of financial Information | 31-Mar-20 | 31-Mar-21 | 30-Jun-21 |

| Total Assets | 698.85 |

793.18 |

763.41 |

| Total Revenue | 465.23 | 683.4 | 128.69 |

| Profit After Tax | 9.74 | 29.56 |

3.34 |

| Total Borrowing | 133.98 | 136.38 | 112.62 |

HSL Mobile App

HSL Mobile App