Elin Electronics Limited IPO

Incorporated in 1969, Elin Electronics Limited is a leading electronics manufacturing services ("EMS") provider. The company is a manufacturer of end-to-end product solutions for major brands of lighting, fans, and small/ kitchen appliances in India, and is one of the largest fractional horsepower motors manufacturers in India.

Elin Electronics Limited manufactures and assembles a wide array of products and provides end-to-end product solutions. The company serve under both original equipment manufacturer ("OEM") and original design manufacturer ("ODM") business models.

The company's diversified product portfolio in EMS includes (i) LED lighting, fans and switches including lighting products, ceiling, fresh air and TPW fans, and modular switches and sockets, (ii) small appliances such as dry and steam irons, toasters, hand blenders, mixer grinders, hair dryer and hair straightener; (iii) fractional horsepower motors, which is used in mixer grinder, hand blender, wet grinder, chimney, air conditioner, heat convector, TPW fans etc.; and (iv) other miscellaneous products.

The company has three manufacturing facilities which are strategically located in Ghaziabad (Uttar Pradesh), Baddi (Himachal Pradesh) and Verna (Goa).

The company also has a centralized R&D centre in Ghaziabad (Uttar Pradesh), focusing on the research and development of all aspects of OEM and ODM models including concept sketching, design refinement, generating optional features and testing.

In Fiscals 2020, 2021 and 2022 and the seven-month period ended October 31, 2022, the company catered to 327, 387, 342 and 297 customers, respectively.

The company's revenue from operations in Fiscals 2020, 2021 and 2022 and the six-month period ended September 30, 2022, was Rs 7,855.84 million, Rs 8,623.78 million, Rs 10,937.54 million and Rs 6,044.57 million.

Objects of the Issue:

The company proposes to utilise the Net Proceeds of the Fresh Issue towards funding the following objects:

- Repayment/ prepayment, in full or part, of certain borrowings availed by the Company.

- Funding capital expenditure towards upgrading and expanding our existing facilities at (i) Ghaziabad, Uttar Pradesh, and (ii) Verna, Goa.

- General corporate purposes.

Company Promoters: Mangi Lall Sethia, Kamal Sethia, Kishore Sethia, Gaurav Sethia, Sanjeev Sethia, Sumit Sethia, Suman Sethia, Vasudha Sethia and Vinay Kumar Sethia are the company promoters.

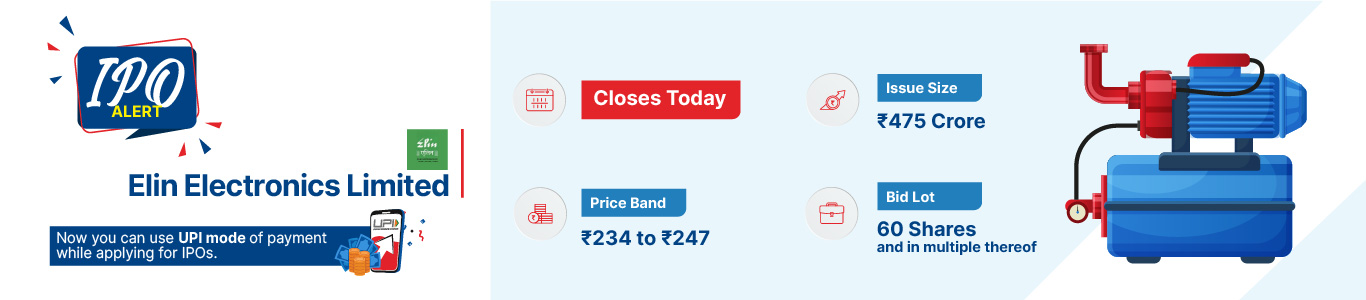

Issue Details

Company Financials

| Particulars | For the year/period ended (₹ in Crores) | ||||

| Summary of financial Information | 31-Mar-19 | 31-Mar-20 | 31-Mar-21 | 31-Mar-22 | 30-Sep-22 |

| Total Assets | 397.73 | 387.63 | 508.31 | 532.61 | 589.24 |

| Total Revenue | 829.74 | 786.37 | 864.9 | 1094.67 | 604.74 |

| Profit After Tax | 29.07 | 27.49 | 34.86 | 39.15 | 20.67 |

| Total Borrowing | 86.64 | 69.89 | 113.77 | 102.33 | 102.77 |

HSL Mobile App

HSL Mobile App