Fedbank Financial Services Limited

Fedbank Financial Services Limited provides Gold Loans, Home Loans, Loan Against Property (LAP) and Business Loan Services.

Fedbank is a retail-focused non-banking finance company (NBFC), with the second lowest cost of borrowing among the micro, small, and medium enterprises (MSMEs), gold loan, and MSME & gold loan peer set in India in Fiscal 2023. The company's clientele comes mainly from the MSME and emerging self-employed individuals (ESEI) sectors.

The company's product range includes mortgage loans such as housing loans; small ticket loans against property (LAP); and medium ticket LAP, unsecured business loans, and gold loans. The company also has a Physical doorstep model, a combination of digital and physical initiatives, for providing customized services to customers across all the products.

As of March 31, 2023, Fedbank Financial Services has offices in 191 districts in 16 states and union territories in India through 575 branches with a strong presence in Southern and Western regions of India including Andhra Pradesh (including Telangana) and Rajasthan.

Competitive Strengths:

- Presence in large, underpenetrated markets with strong growth potential.

- Focused on retail loan products with a collateralized lending model targeting individuals and the emerging MSME sector which is difficult to replicate.

- Strong underwriting capability and presence in select customer segments combined with robust risk management capabilities focused on effective underwriting and collections.

- Experienced, cycle-tested management team.

- Well-diversified funding profile with the advantage of lower cost of funds - Technology-driven company with a scalable operating model.

Objects of the Issue:

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

- Augmenting the company's Tier I capital base to meet the company's future capital requirements, arising from the growth of the business and assets.

- Meeting offer expenses.

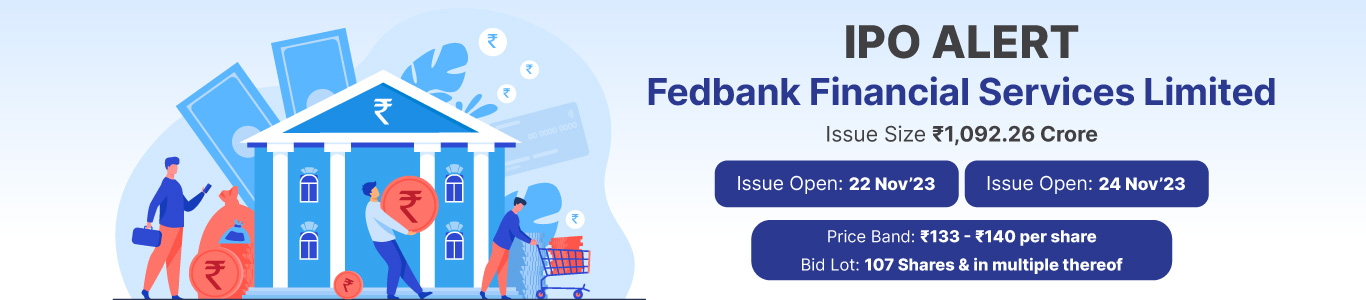

Issue Details

Company Financials

| Period Ended | 31-Mar-23 | 31-Mar-22 | 31-Mar-21 |

| Assets | 9,070.99 | 6,555.71 | 5,466.31 |

| Revenue | 1,214.68 | 883.64 | 697.57 |

| Profit After Tax | 180.13 | 103.46 | 61.68 |

| Net Worth | 1,355.68 | 1,153.52 | 834.73 |

| Reserves and Surplus | 1,021.52 | 832 | 544.45 |

| Total Borrowing | 7,135.82 | 5,016.84 | 4,328.09 |

HSL Mobile App

HSL Mobile App