KFin Technologies Limited IPO

Incorporated in 2017, KFin Technologies Limited is a leading technology-driven financial services platform. The company provides services and solutions to asset managers and corporate issuers across asset classes in India and provides several investor solutions including transaction origination and processing for mutual funds and private retirement schemes in Malaysia, the Philippines and Hong Kong.

As on September 30, 2022, the company is India's largest investor solutions provider to Indian mutual funds, based on several AMC clients serviced. The company is also servicing 301 funds of 192 asset managers in India as on September 30, 2022.

As on September 30, 2022, KFin Technologies Limited is the only investor and issuer solutions provider in India that offers services to asset managers such as mutual funds, alternative investment funds ("AIFs"), wealth managers and pension as well as corporate issuers in India.

KFin Technologies Limited is one of the two operating central record-keeping agencies ("CRAs") for the National Pension System (" NPS") in India as on September 30, 2022.

KFin Technologies Limited is India's largest issuer solutions provider based on several clients serviced, as of September 30, 2022.

The company has classified its products and services in the following manner:

- Investor solutions -(Account Setup, Transaction Origination, Redemption, Brokerage Calculations, Compliance / Regulatory Reporting Recordkeeping).

Domestic mutual funds, International, Pension services, Alternatives and wealth management.

- Issuer solutions (Folio Creation and Maintenance, Transaction Processing for IPO, FPO, etc. Corporate Action Processing, Compliance / Regulatory Reporting Recordkeeping MIS, Virtual Voting e-AGM, e-Vault).

- Global business Domestic mutual services (Mortgage Services Legal Services Transfer Agency Finance and Accounting).

The company's revenue from operations for Fiscal 2022 and the six months ended September 30, 2022, was Rs 6,395.07 million and Rs 3,487.68 million, respectively.

Objects of the Issue: The company will not receive any proceeds from the Offer and all such proceeds will go to the Promoter Selling Shareholder.

Company Promoter: General Atlantic Singapore Fund Pte. Ltd. is the company promoter.

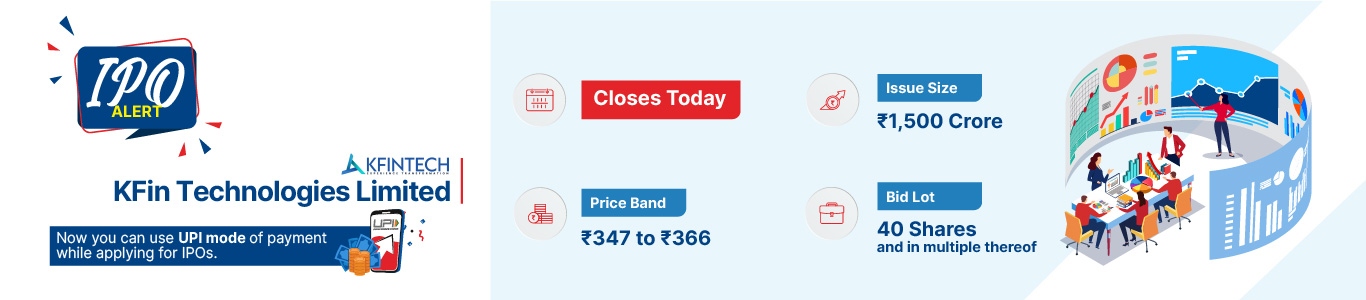

Issue Details

Company Financials

| Particulars | For the year/period ended (₹ in Crores) | |||||

| Summary of financial Information | 31-Mar-19 | 31-Mar-20 | 31-Mar-21 | 30-Sep-21 | 31-Mar-22 | 30-Sep-22 |

| Total Assets | 1021.78 | 868.38 | 922.61 | 973.26 | 1026.41 | 1114.81 |

| Total Revenue | 164.76 | 455.26 | 486.2 | 293.43 | 645.56 | 353.76 |

| Profit After Tax | 8.96 | 4.52 | -64.51 | 67.8 | 148.55 | 85.34 |

| Net Worth | 519.28 | 409.58 | 346.4 | 269.95 | 644.34 | 736.72 |

| Total Borrowing | 406.01 | 375.44 | 346.13 | 321.44 | 122.51 | 126.24 |

HSL Mobile App

HSL Mobile App