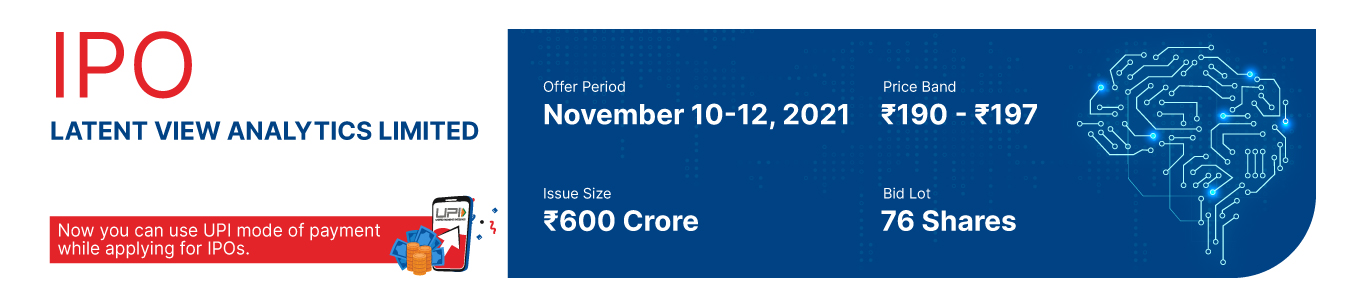

Latent View Analytics Limited IPO - Issue opens on Nov 10, 2021

Incorporated in 2006, Latent View provides analytics services such as data and analytics consulting, business analytics & insights, advanced predictive analytics, data engineering, and digital solutions. The company provides services to blue-chip companies in Technology, BFSI, CPG & Retail, Industrials, and other industry domains. The company classifies its business into - (i) Consulting services, which involves understanding relevant business trends, challenges, and opportunities and preparing a roadmap of data and analytics initiatives that addresses them; (ii) Data engineering, to design, architect, and implement the data foundation required to undertake analytics; (iii) Business analytics, which delivers analysis and insights for clients to make more accurate, timely and impactful decisions; and (iv) Digital solutions which the company develops to automate business processes, predict trends and generate actionable insights.

The company has a presence across countries in the United States, Europe, and Asia through their subsidiaries in the United States, Netherlands, Germany, United Kingdom, and Singapore, and their sales offices in San Jose, London, and Singapore. Latent View has worked with over 30 Fortune 500 companies in the last three fiscals and some of the key clients include Adobe, Uber Technology, and 7-Eleven.

Objects of the Issue:

- Funding inorganic growth initiatives;

- Funding working capital requirements of Latent View Analytics Corporation, company’s material subsidiary;

- Investment in subsidiaries to augment their capital base for future growth; and

- General corporate purposes

Competitive Strengths:

- One of the leading pure-play data analytics companies in India

- Extensive experience across a range of data and analytics capabilities

- Blue-chip clients across industries and geographies

- Focus on innovation and R&D

- Scalable and attractive financial profile

- Strong, experienced leadership team

Company Promoters:

Adugudi Viswanathan Venkatraman and Pramadwathi Jandhyala are the company promoters.

Issue Details

Company Financials

| Particulars | For the year/period ended (₹ in million) | ||||

| Summary of financial Information (Restated Consolidated) | 30-Jun-21 | 30-Jun-20 | 31-Mar-21 | 31-Mar-20 | 31-Mar-19 |

| Total Assets |

5,880.08 |

4,488.80 |

5,191.99 |

3,978.54 |

3,236.83 |

|

Total Revenue |

917.43 | 823.81 | 3,267.08 |

3,296.72 |

2,959.03 |

|

Profit After Tax |

223.14 |

228.04 |

914.63 |

728.45 |

596.65 |

HSL Mobile App

HSL Mobile App