Mankind Pharma Limited

Incorporated in 1991, Mankind Pharma Limited develops, manufactures, and markets pharmaceutical formulations across various acute and chronic therapeutic areas and several consumer healthcare products.

In India, the business is active in a number of acute and chronic therapeutic fields, including anti-infectives, cardiovascular, gastrointestinal, anti-diabetic, neuro/CNS, vitamins/minerals/nutrients, and respiratory.

It has over 36 brands, including Manforce (Rx), Moxikind-CV, Amlokind-AT, Unwanted-Kit, Candiforce, Gudcef, Glimestar-M, Prega News, Dydroboon, Codistar, Nurokind-Gold, Nurokind Plus-RF, Nurokind-LC, Asthakind-DX, Cefakind, Monticope, Telmikind-H, Telmikind, Gudcef-CV, and Unwanted-72, among them.

Mankind Pharma has one of the largest distribution networks of medical representatives in the Indian pharmaceutical market ("IPM"). Over 80% of doctors in India prescribed their formulations and has been ranked number 4th in terms of domestic sales during the Financial Year 2022.

The company has been awarded The Best of Bharat Awards 2022 by exchange4media in the year 2022, Silver Medal from National Awards for Manufacturing Competitiveness Assessment 2021 instituted by International Research Institute for Manufacturing, and Silver Award for Good Health Brand at IHW Awards 2021 in the year 2021, Best Condom Brand of the Year award at Sex Brand Awards Pharma OTC Company of the Year Award at Pharma Excellence Awards 2018, Award for Best Design in Healthcare at Healthcare Leadership Awards 2017, and Amity HR Excellence Award for Performance Management at the 8th Global HR Summit 2011.

Objects of the Issue: The company will not receive any proceeds from the Offer and all the Offer Proceeds will be received by the Selling Shareholders, in proportion to the Offered Shares sold by the respective Selling Shareholders as part of the Offer

Company Promoter: Ramesh Juneja, Rajeev Juneja, Sheetal Arora, Ramesh Juneja Family Trust, Rajeev Juneja Family Trust, and Prem Sheetal Family Trust are the company promoters.

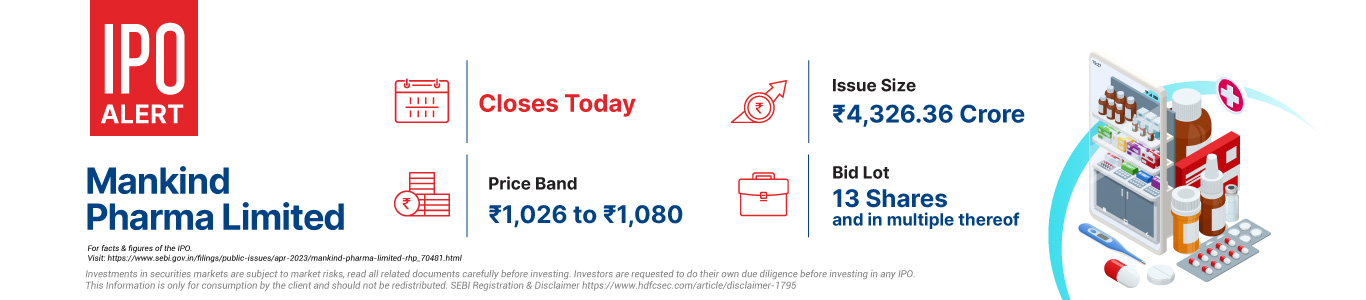

Issue Details

Company Financials

| Period Ended | Total Assets | Total Revenue | Profit After Tax | Net Worth | Reserves and Surplus | Total Borrowing |

| 31-Mar-20 | 5,073.29 | 5,975.65 | 1,056.15 | 3,485.31 | 3,436.34 | 126.92 |

| 31-Mar-21 | 6,372.63 | 6,385.38 | 1,293.03 | 4,722.00 | 4,674.39 | 234.53 |

| 31-Dec-21 | 8,043.88 | 6,218.29 | 1,260.24 | 5,965.46 | 0 | 268.7 |

| 31-Mar-22 | 9,147.74 | 7,977.58 | 1,452.96 | 6,155.23 | 6,106.06 | 868.03 |

| 31-Dec-22 | 9,273.75 | 6,777.82 | 1,015.98 | 7,145.89 | 0 | 167.93 |

HSL Mobile App

HSL Mobile App