PKH Ventures Limited

Incorporated in 2000, PKH Ventures Limited is engaged in the business of Construction & Development, Hospitality, and Management Services.

PKH Ventures executes Civil Construction works for Third Party Developer projects. The Civil Construction business is executed by its Subsidiary and construction arm, Garuda Construction.

The company concluded the development of the Delhi Police Headquarters in April 2021, which involved the construction of twin towers of seventeen (17) storeys each, with a complete glass façade and steel bridge connecting the two towers. The company is proposing to develop its own Forthcoming Development Projects, which include real estate development at Amritsar, Punjab; a food park at Jalore, Rajasthan; cold storage park/facilities at Indore, Madhya Pradesh; and a wellness center & resort at Chiplun, Maharashtra.

PKH Ventures' Hospitality vertical is in the business of owning, managing, and operating hotels, restaurants, QSRs, spas, and the sale of food products. The company currently provides miscellaneous mechanical, electrical, and plumbing ("MEP") works services such as annual maintenance of its projects and certain third-party O&M contracts. The company has developed two hotels in Mumbai viz., Golden Chariot Hotel & Spa, Vasai and Golden Chariot, The Boutique Hotel near Mumbai International Airport ("Mumbai Hotels") and has been owning, managing and operating the 180 Mumbai Hotels since FY 2015.

PKH Ventures has been awarded with two Government Projects viz., the Hydro Power Project and the Nagpur Project, being executed through its Subsidiaries/SPVs.

Objects of the Issue:

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

- Investment by way of equity in our subsidiary, Halaipani Hydro Project Private Limited for the development of Hydro Power Project (Civil Construction and Electromechanical Works),

- Investment in Garuda Construction project, for funding long-term working capital requirements,

- Acquisitions and other strategic initiatives; and

- To fund expenditures towards general corporate purposes.

Company Promoter: The promoter of the company is Mr. Pravin Kumar Agarwal.

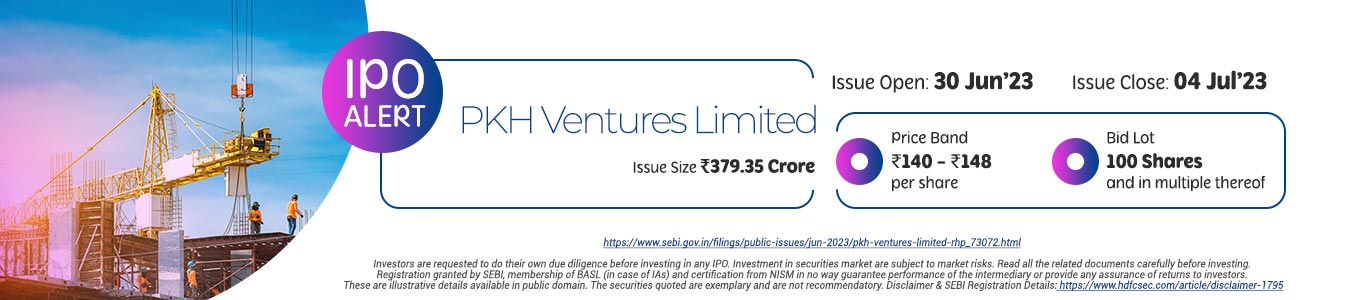

Issue Details

Company Financials

| Period Ended | Total Assets | Total Revenue | Profit After Tax | Net Worth | Reserves and Surplus | Total Borrowing |

| 31-Mar-20 | 244.81 | 169 | 14.09 | 149.4 | 141.96 | 25.91 |

| 31-Mar-21 | 1,077.04 | 264.66 | 30.57 | 184.72 | 177.03 | 96.69 |

| 31-Mar-22 | 1,102.45 | 245.41 | 40.52 | 327.38 | 295.68 | 98.24 |

| 31-Dec-22 | 1,248.03 | 155.03 | 28.64 | 356.01 | 172.01 |

HSL Mobile App

HSL Mobile App