Sansera Engineering Limited IPO

Incorporated in 1981, Sansera manufactures complex and critical precision engineered components and caters across automotive and non-automotive sectors. The company manufactures and supplies a wide range of precision forged and machined components and assemblies which are critical for the two-wheeler, passenger vehicle, and commercial vehicle verticals for the automotive sector. For the non-automotive sector, the company manufactures and supplies a wide range of precision components for aerospace, off-road, agriculture, and other segments. The company mostly supplies forged & machined products to OEM’s.

For FY’21, the Automotive sector contributed 88.45% and non-automotive 11.45% of the revenue. The company derives around 65% of its revenue from India and the rest 35% from other countries. The company is one of the major suppliers of connecting rods globally. The company has 15 manufacturing plants across India of which 9 are in Bangalore.

Competitive Strengths:

- Leading supplier of complex and high-quality precision engineered components across automotive and non-automotive sectors which are poised to grow strongly.

- A well-diversified portfolio of segments, products, customers, and geography.

- Strong Engineering & Designing capabilities.

- Strong relationships with respected Indian and Global OEM’s.

- Strong financial performance.

- Skilled and experienced management team.

Company Promoters:

- S Sekhar Vasan, F R Singhvi, Unni Rajagopal K and D Devaraj are the company promoters.

Company Financials

| Particulars | For the year/period ended (₹ in million) | ||

| Summary of financial Information (Restated Consolidated) | 31-Mar-21 | 31-Mar-20 | 31-Mar-19 |

| Total Assets | 19,288.83 | 18,282.36 | 17,454.84 |

| Total Revenue | 15,723.64 | 14,731.39 | 16,408.09 |

| Profit After Tax | 1,098.60 | 799.05 | 980.64 |

Objects of the Issue:

The objects of the Offer are;

- To carry out the Offer for Sale of up to 17,244,328 Equity Shares by the Selling Shareholders; and

- achieve the benefits of listing the Equity Shares on the Stock Exchanges.

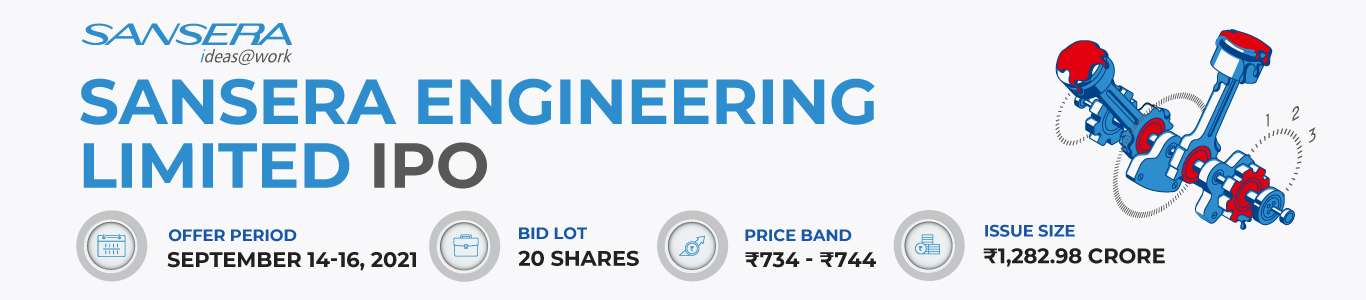

Issue Details

HSL Mobile App

HSL Mobile App