Tracxn Technologies Limited IPO

Founded in 2013, Tracxn Technologies provides market intelligence data for private companies. The company's extensive global database and customized solutions and features allow its customers to source and track companies across sectors and geographies to address their requirements.

The company is ranked among the top five players globally in terms of the number of companies profiled offering data on private market companies across sectors and geographies. The company has an asset light business model and operate a Software as a Service ("SaaS")-based platform, Tracxn, that scanned over 662 million web domains, and profiled over 1.84 million entities across 2,003 Feeds categorized across industries, sectors, sub-sectors, geographies, affiliations and networks globally, as of May 31, 2021.

The company has 3,271 users across 1,139 Customer Accounts in over 58 countries, as of June 30, 2022, and its customers include several Fortune 500 companies and/or their affiliates.

The company offers private company data to its customers for deal sourcing, identifying M&A targets, deal diligence, analysis, and tracking emerging themes across industries and markets, among other uses, through its Tracxn platform.

Objects of the Issue:

To achieve the benefits of listing the equity shares on the Stock Exchanges and the sale of up to 38,672,208 Equity Shares by the selling shareholders

Competitive Strengths:

- One of the leading providers of market intelligence data for private companies globally

- Diverse, longstanding, and growing global customer base

- In-house developed, scalable, and secure technology platform

- Significant cost advantages from India-based operations

- Experienced promoters, board of directors, and senior management team backed by marquee investors

Company Promoters: Neha Singh and Abhishek Goyal are the company promoters

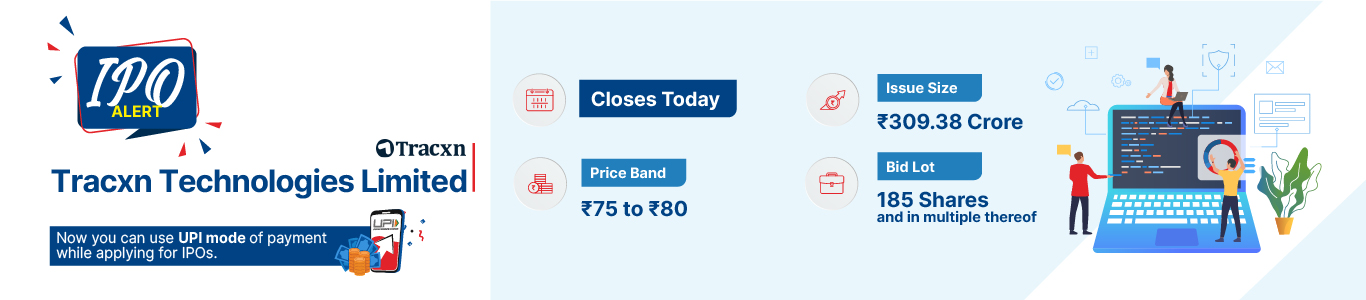

Issue Details

Company Financials

| Particulars | For the year/period ended (₹ in Crore) | ||||

| Summary of financial Information | 30-Jun-22 | 30-Jun-21 | 31-Mar-22 | 31-Mar-21 | 31-Mar-20 |

| Total Assets | 56.78 | 49.93 | 54.01 | 48.46 | 52.38 |

| Total Revenue | 19.08 | 15.44 | 65.16 | 55.74 | 6.31 |

| Profit After Tax | 0.923 | -0.83778 | -4.852 | -4.152 | -54.826 |

| Net Worth | 22.98 | 22.04 | 20.64 | 22.22 | -135.24 |

| Reserves and surplus | 12.95 | 21.14 | 10.61 | 21.32 | -135.44 |

HSL Mobile App

HSL Mobile App